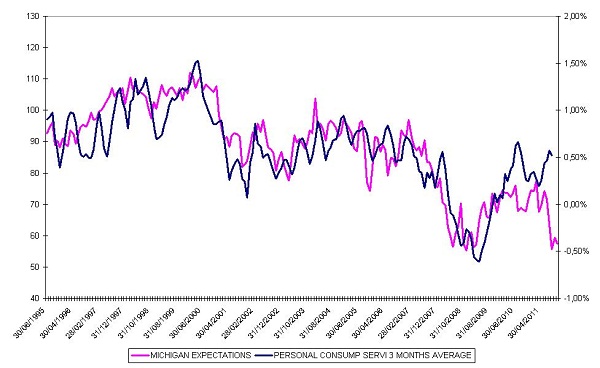

How is it possible that while US consumer confidence is falling, we are seeing a rebound in personal consumption?

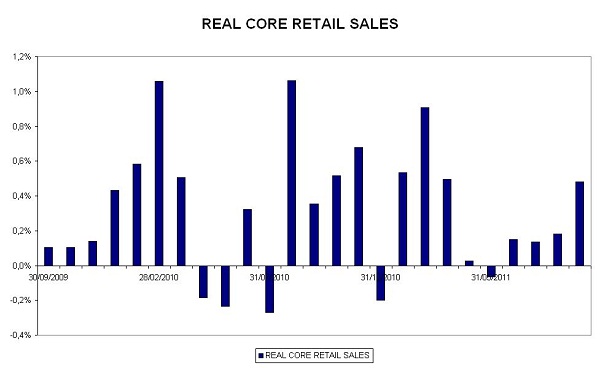

On Friday, although the confidence data showed a decline in consumer expectations, retail sales showed a strong recovery (even in real terms); if we add the car sales data from last week (sales rose to 13.1 million units when only two months ago they were 11) we have to ask the question: what is going on here? Why the distance between consumption and confidence?

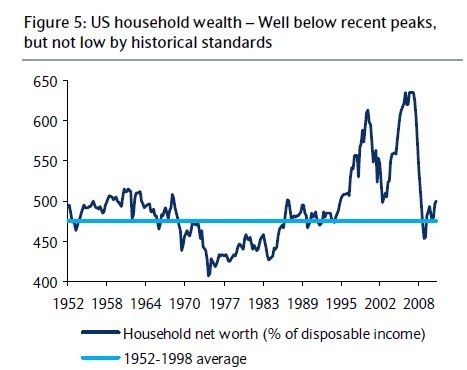

At Barclays, analysts have a theory. Consumption must be linked to wealth ratios of families instead of gross debt or disposable income only.

At Barclays, analysts have a theory. Consumption must be linked to wealth ratios of families instead of gross debt or disposable income only.

Okay! You must be thinking that with falling house prices, families in debt and so on, this wealth index won't very buoyant. That assumption is correct, but even so, as you see in the chart below, household wealth is not particularly low by historical standards.

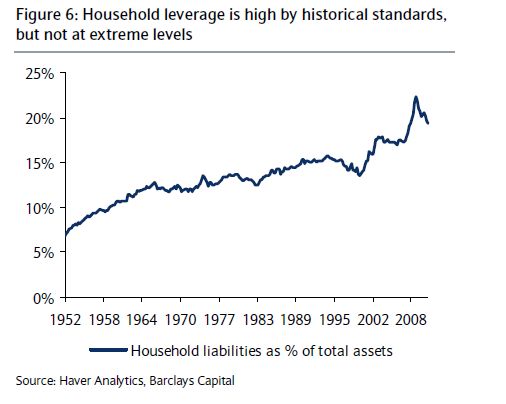

Then, what about the debt? Household debt is at a record high! This is true, but we have already taken into account the debt in the chart above when we talked about family wealth, as we have always referred to the latter on a net basis. And besides, would it not make sense to not only analyze the debt as a percentage of disposable income or GDP but also as a percentage of wealth? If we d

o it this way, we see that the household debt represents only 20% of the total wealth, so the consumer is far from having become a hedge fund.

This would explain why consumers continue spending. In addition, forecasts suggest that the situation of this wealth ratio will tend to improve thanks to a reactivation of the housing sector. Construction of new housing in the US is at levels that are too low to meet the demographic needs of the country or even current sales, so it's only a matter of time before we see a revival of the residential housing sector in the US.

In summary, the economic data continue to support investing in equity funds and, although we would like to have a better idea of what the EU intends to do to solve the European crisis, the comments we are hearing by members of the G20 generally are positive.

The EU looks like it could opt to secure between 20% to 30% of future debt issues by Spain and Italy, and perhaps another country; Greece's debt would be reduced by 50/60% and the banks involved would be recapitalized. Moreover, it seems likely that a greater bank recapitalization will be required in preparation of the upcoming stress test, which will take into consideration the possibility of default by a sovereign state. In our view, this is the most controversial point and could produce uncertainties.

Will the financial institutions continue buying sovereign debt if these countries force them to raise capital? Will the ECB be able to offset the possible decline in demand by the banks?

For now we must continue to invest in equities. Now enjoy, we deserve it.