The mood among investors who attended the Spain Investors Day was one of courage. Most large investors forecast that the Spanish index Ibex35 will rally in 2013 and the government finances will resist without having to require a Brussels bailout.

According to a survey carried out by Exane and BNP Paribas, 85 percent of the biggest investing houses participant in the event in Madrid this week are optimistic about a Spanish stock market recovery, and 73 percent expect a move upwards of between 10 percent and 20 percent. About 50 percent of the attendees said financials would lead the improvement in prices.

Spain Investors Day, a specialised forum in Spain where international investors can obtain first‐hand information about major Spanish companies, noted that at least half of the members who travelled to Madrid are based in Europe and Asia, with 25 percent of them in the UK.

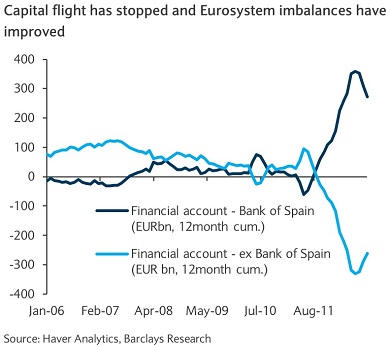

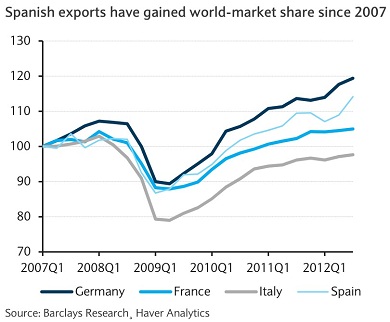

The results of this opinion poll seem to confirm the research paper on Spain published Friday by Barclays, in which analysts concluded that “the worst may be over” in spite of downside risks being elevated. “We no longer think that Spain will ask for a programme,” Barclays explained regarding a possible national rescue, “the threat of outright market transaction activation [the European Central Bank would directly purchase short-term sovereign debt] may be just enough to deter investors from taking short Spain positions of the size that occurred in the first six months of 2012.”

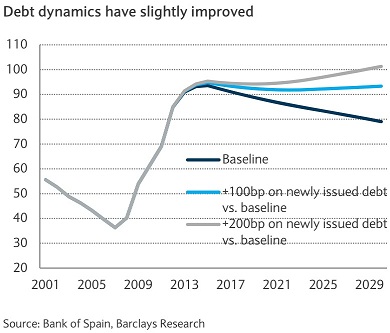

The report indicates that financial conditions have relaxed for government debt and will ease the current adjustment applied over the public and private sectors. On the macroeconomic horizon, though, there are some doubts still fresh.

“Spain’s macroeconomic fundamentals remain very weak in an environment where the private sector is in a protracted deleveraging process, the housing bubble is deflating, and the public sector has much consolidation to do.” Barclay estimates the state sector should shrink 6 percentage points of GDP before 2016 to reach a primary surplus and cut down its debt pile.

Be the first to comment on "Investors eye Ibex35 recovery as Barclays report signals worst may be over"