LONDON | US equities’ outperformance is becoming exhausted and investors should look through the euro smoke for opportunities, JP Morgan advised clients in its latest weekly strategy report. In spite of agreeing in line with consensus, analysts’ recommendation was to open ears to what the arguments might be in support of European equities.

Is it time to go overweight Europe?, the investment entity asked in its paper. Although every investor’s favourite regional equity bet seems to be underweight Europe against overweight the US, JP Morgan said unanimous attitudes in markets are better dealt with some dose of scepticism.

“The political backdrop in Europe is, of course, horrible, with speculation over a possible Greek eurozone exit reaching fever pitch and safe-haven flows driving German bond yields to new all-time highs on a daily basis. And the longer-term structural perspective for Europe still looks challenging to say the least.

However, the political surprise can cut both ways and better news out of Greece or the announcement some sort of new bailout agreement could be an obvious trigger for a spurt of European equity outperformance.”

Data supports a measure of optimism. The good news from the crisis-front is that the interbank market has been apparently unaffected by euro zone worries. JP Morgan believes liquidity made earlier in the year available by the European Central Bank clearly had the desired effect, and this would limit downside risk in European equities in the short term.

Again, this is reflected in the relative performance numbers. European equities have fallen by about 8.3% from the mid-March high, but are still up 1.7% year to date.

“The stuff of panic this is not,” JP Morgan analysts remarked. “However, even on this short term perspective US equities have been by far the better bet with the S&P 500 up by 8% year to date and down by only 4.6% since the mid-March peak.”

There is no denying that Europe has in the longer term perspective essentially been underperforming the US since April 2007, interrupted by just a few noteworthy bounces. Overall underperformance has been -28% in total return terms. So what would be the case for a tactical overweight?

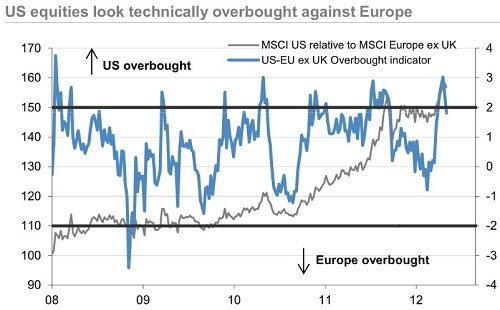

“For one, US equities look very much overbought relative to Europe (about 1.8 standard deviations on our own measure), and there are some early signs the outperformance is becoming exhausted.

“Second, investor positioning on the pair is extreme: according to the latest Bank of America Merrill Lynch Fund Manager survey a net 32% of investors are underweight Europe, which is more than 1.6 standard deviations more negative than usual. At the same time, a net 26% are overweight the US (1.6 standard deviations more positive than average).

“A gap in preference this large signals a clear risk of a sharp and potentially sizeable reversal in performance –should there be sufficient catalysts.

“Third earnings momentum has turned up more sharply in Europe than in the US (albeit from a worse starting position),which has historically been a good lead indicator for European outperformance –but so far this has been ignored by markets.

“Fourth, on the economic side, longer leading indicators for Europe have started to turn upwards. So while we are unlikely to change our cautious intermediate view on Europe, the odds for a short-term bout of European outperformance are increasing.”

Be the first to comment on "JP Morgan says European equities’ in recovery mode"