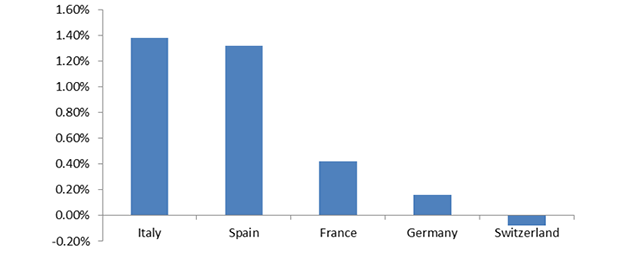

Investors are feeling insecure about the short term, a logical reaction given how much markets have risen since the beginning of the year. European stocks are up by + 20% and an important portion of European rates has already reached negative territory.

However, the expansive economic cycle continues to be solid, Bankinter analysts highlighted in their Monday report. And we should not forget that the support of the central banks is in practical terms, and although it may seem an exaggeration, infinite.

Liquidity does not only come from central banks, but also from the increase in wealth as a result of the improving economic environment. This factor, combined with the absence of alternatives without risk, has given the market a lot of stamina. So an incresase in earnings will not come as a surprise. But nothing important is changing, and all this is likely to be a mere healthy adjustment.

Be the first to comment on "Does it make sense to keep buying despite negative yields?"