The Spanish small capitalisation market has been performing better than the general index Ibex in 2013. BNP Paribas’ brokerage house Cortal Consors on Monday said in an investor note that small caps have recorded an 11 percent rise while Ibex lagged behind with a 3.8 percent increase.

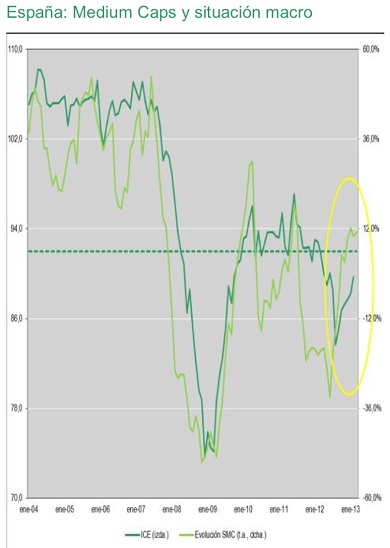

The reason would be that “the SMC index shows a higher correlation degree to the country’s economic situation–the index of economic sentiment or ICE–than the general index. We expect the ICE to stabilise above 90 points,” Cortal Consors analysts explained.

But the GDP contraction in most macroeconomics scenarios for Spain could be of at least over -1 percent. That is why the small cap index may suffer from excessive valuation and “during the rest of the year, the Ibex should improve its performance against the SMC,” according to BNP Paribas broker. It also added, nevertheless, that Spain’s trade deficit in January fell to -€3.5 billion (it was -€3.7 twelve months ago) due to “renewed dynamism” in exports activity.

Be the first to comment on "Monday’s chart: hopeful about the Ibex"