Good news for Berlin? The opposition gang against the European Central Bank injecting money freshly minted, whether by buying state bonds or providing direct loans to lenders, would have received a boost in this week’s bulletin published by the Laboratoire Européen d’Anticipation Politique (Leap). Data from the US, where monetary expansion policies have been used with profusion, vindicated those in Europe who claim it makes no difference unless structural unbalances are first solved.

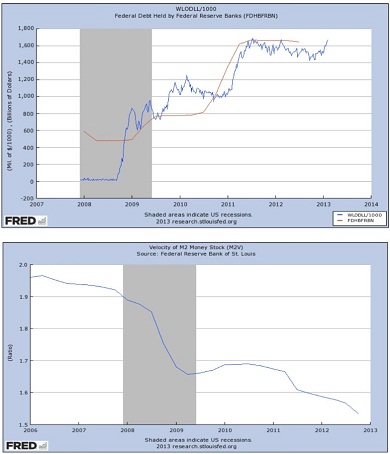

Two simple charts in the Leap paper show how banks in the US are, in fact, replicating the behaviour of their European colleagues: credit is being stacked in risk-free deposits with the Federal Reserve instead of flowing into the economy.

“To exit the crisis,” Leap analysts noted, “the US face tough and limited choices.” One would be to partially default on its debt, which it cannot–unlike some European countries–because its dependence on market investment is too high, and because it would discourage the rest of the world from seeing the US dollar as their currency of reference. Then, there is the option of increasing inflation levels, which should reduce the volume of debt payments and re-activate the economic activity.

Here is the weird bit, though. “Despite the Fed’s massive money printing action, inflation isn’t solid enough for the US economy or public finances to take any advantage of it.” There is more liquidity, but money circulation keeps dropping lower and lower.

Still, pro-monetary expansion Europeans can denounce that Europe suffers worse unemployment and average GDP rates than the US. Some consolation.

Be the first to comment on "Monetary expansion is proving useless in the US"