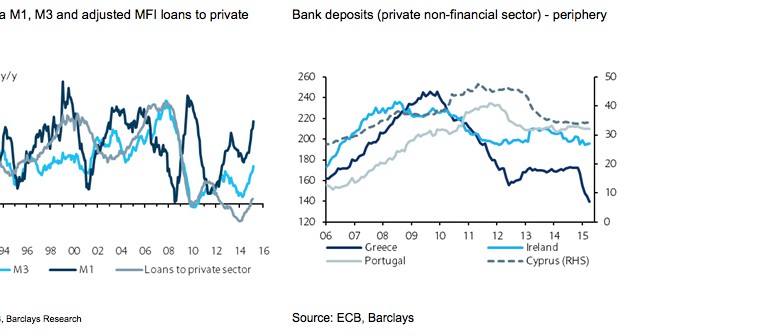

Euro area broad money M3 surged by EUR74bn and annual M3 growth accelerated to 5.3% y/y in April, up from 4.6 % the previous month. Narrow money M1 growth rose to 10.5% and the demand for cash (currency in circulation) rose strongly by EUR10bn, pushing up its annual growth rate to 8.2% y/y. Households and non-financial corporates (NFCs) both further added to their deposits, EUR13bn and EUR1bn respectively. But the biggest increase came from non-monetary financial institutions (excluding insurance firms and pension funds) which added EUR14bn to their bank accounts.

Greece stood out again as the exception. Deposit flight picked up again in April as indicated by the news on higher ELA provision by the ECB that month. Excluding the central government accounts, bank deposits fell by EUR5.7bn in April (after EUR2.5bn in March). In particular, households withdrew EUR3.5bn in cash but NFCs also pulled out another c.EUR1bn.

On the M3 counterpart side, lending to the private sector (adjusted for sales and securitisations) amounted to EUR20bn and the annual growth rate remained rather subdued at 0.8% y/y. Lending to NFCs hardly rose at all (up EUR2bn) and its annual growth rate remained in negative territory at -0.1% y/y, but slightly up compared to March (-0.2% y/y). In the southern periphery further stabilisation of NFC lending is visible (Figure 3) and bank loans to French firms are growing at a strong pace. As the Bundesbank has pointed out in its Monthly Bulletins, the rising gap between bank loan provision to NFCs in France and Germany mainly reflects less favourable conditions for other sources of external financing in France and lower corporate profits compared with Germany. All in all, the continuation of weak lending dynamics to euro area NFCs is a reflection of corporate deleveraging and weak investment activity.

Household lending growth rose by EUR13bn (1.3% y/y) as both mortgage and consumer credit provision picked up further in April. This signals that consumer demand remains the main pillar of GDP growth in the euro area at this juncture.

In terms of debt securities, euro area banks continued to shed corporate bonds in April (-EUR9bn) but strongly added to their holdings of government bonds (+EUR38bn, seasonally adjusted), especially in France.

The support from net external assets to M3 growth continues to moderate. In the 12-month period to April 2015, the inflow into MFIs’ net external assets was EUR110bn compared with an historical peak of EUR412bn in the 12-month period to July 2014. While the current account surplus of the balance of payments continues to be a positive factor, sizeable purchases by euro area residents of foreign debt securities, combined with net redemptions by foreigners of debt securities issued by euro area residents, had a negative effect over the past year.

Be the first to comment on "Money growth up sharply while eurozone bank lending remains subdued"