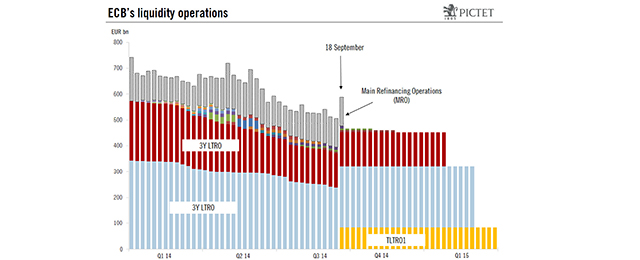

Thursday’s response to the ECB’s second TLTRO is crucial, especially after the little success of mortgage bonds (€3.1bn from last week vs €5.1bn from the previous week; for a total of €21bn vs the eligible universe of €600bn), and most especially ABS purchases (€286 billion last week and €386bn from the previous one; for a total of €601bn within a universe of €400bn).

After the €83 billion demanded in September’s TLTRO, experts at Santander estimate that lenders will ask for up to €160 billion on Thursday –even though the ECB decided not to soften the terms.

Bloomberg’s consensus forecasts a wide range of €90-250 billion, the median being €148 billion. The major events will take place next week (FOMC on December 17) and at the beginning of 2015 (when the European Court of Justice is due to establish the legality of the ECB’s Outright Monetary Transactions (OMT) programme on January 14).

Be the first to comment on "Next TLTRO may reach €160 billion"