Repsol’s sale of a 20% stake in Gas Natural to CVC is near to being closed. The UK fund’s interest in the block of shares was already known at the start of the year. The current value at market prices of 20% of Gas Natural is 3.708 billion euros.

This posible sale was one of the alternatives Repsol had to reduce debt when its rating was at risk of being revised downwards to BB- (from BBB-) against a backdrop of crude prices below 40$/barrel. But with crude above 60$/barrel, its rating recently revised upwards to BBB with a stable outlook, net debt at 6.972 billion euros in Q3 (vs 9.988 billion in Q3’16 and 7.477 billion in Q2’17) and Net Debt/Ebitda of 1.0% (vs 2.18% in Q3’16 and 1.28% in Q2’17), Bankinter analysts believe the “timing of sale doesn’t make much sense.”

In addition, there is the uncertainty surrounding the posible modification to the regulatory framework.

This could put downward pressure on the sale price during Repsol’s negotiations with CVC. Since news of the sale of 20% of Gas Natural filtered through, its market price has fallen from 4.102 billion euros (10/01/2018) to 3.708 billion euros currently.

However, Repsol also faces another challenge. In fact, the stock has fallen nearly 6% in the year so far and more or less 13% since its highs in September dragged down with volatility and massive markets sell-off in last weeks.

According to Morgan Stanley, this recent correction once again provides an interesting and advantageous level to buy into the stock. The investment bank values the sector’s fundamentals to support this view. Firstly, corporate earnings in the industry, which have been good (despite the drop in oil prices) in this period of results. Yet the sector’s performance has been very weak. And secondly, global demand for crude remains strong.

Whatsmore, bearing in mind that Total and Statoil have raised their dividend, Morgan Stanley believes that the next company to eliminate the scrip dividend as Royal Dutch did, or increase it like Total and Statoil, could be Repsol.

If Repsol raises its dividend from 0,8 euros to 1 euro as our analysts expect at year-end, the dividend yield would be around 7.2%. And it’s worth highlighting that its two biggest shareholders (not surprisingly) are pushing for this to happen.

Finally, the company’s exposure to refining is clearly a plus. Refining margins and utilization ratios remain solid.

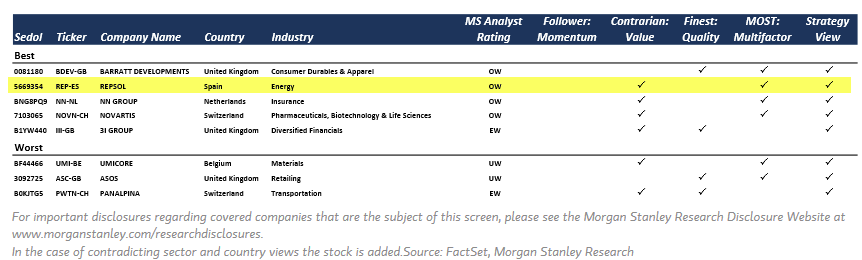

In the quantitative analysis of MS’ strategies, the Spanish firm is very well positioned.