Mario Draghi, governor of the European Central Bank, spoke on Thursday of the dire path the eurozone has ahead to find its way to recovery. My five cents would be that the relaxation of Basel III rules is to be welcomed, and that markets tend to normalisation under certain circumstances. The contagion effect works in reverse, too, so the whole euro area revives when there is an economic reshuffle. Unforeseeable risks are being eliminated, which is good news, although there isn’t yet a plan to cancel non-orthodox measures to help euro countries in financial trouble.

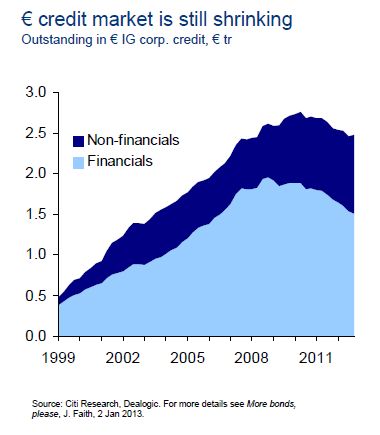

Also, the credit market contraction is a structural process.

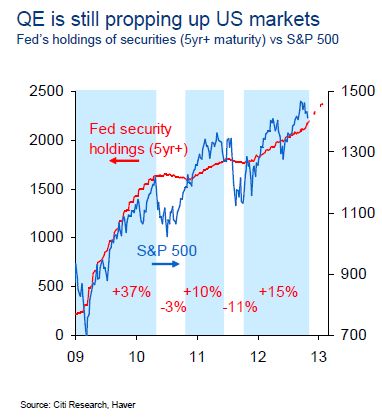

In spite of the US Federal Reserve message of implied commitment to prop up the economy with monetary expansion policies, this can’t be unlimited.

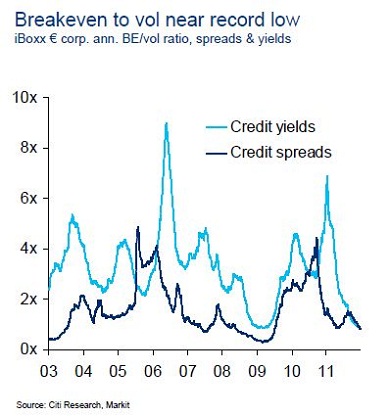

Isn’t volatility a risk and uncertainty indicator?

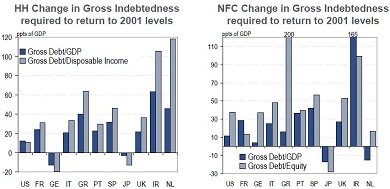

There’s still a long way to go to cut leverage excess.

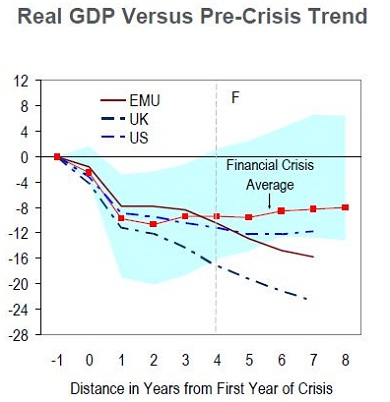

And economic growth is elusive in this scenario of financial crisis and deleverage stress.

Be the first to comment on "The Draghi speech in six charts"