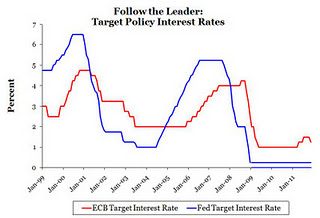

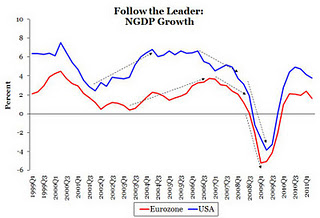

By Luis Arroyo, in Madrid | In “ECB needs Fed now more than ever,” David Beckworth makes a rigorously correct note: the Fed could help the euro through ECB’s reaction function to movements in Fed’s interest rates. In fact, the Fed is the dominant Central Bank here, and its movements precede all the rest (see monetary superpower). In the first graphic, it is clear that movements in official rates begin with the Fed and the ECB just works along. What is even more significant, as we can see in the second graphic is that the US’s NGDP cycles precede those of the euro zone. Were the Fed to expand the money supply, the ECB would have to follow if it did not want the euro to appreciate further and harden financial difficulties.

As Beckworth says:

“The Fed, therefore, should be able to help spur nominal spending growth in the Euro Zone by doing something radical, like adopting a NGDP level target that would return U.S. NGDP to its pre-crisis trend. This would imply aggressive monetary easing by the Fed that, in turn, would put downward pressure on the dollar. This would create the incentive for the reluctant Germans, who seem to care as much about their exports as they do about inflation, and the ECB to get serious about opening their monetary spigots. In other words, a sufficiently aggressive Fed would provide the cover for the ECB to do what it needs to have done all along.

“Of course, a more efficient way to do this would be a coordinated effort, such as the plan suggested by Lars Christensen, where the major central banks of the world work together to raise their nominal spending to pre-crisis trend levels. But since this type of coordination does not seem likely anytime soon, it seems natural for the reigning monetary superpower to take the lead and start a global nominal spending recovery.”

Unfortunately, this beneficious coordination is unthinkable. One cannot imagine Merkel saying, Well, let’s go for it. So here’s one more perplexity to add to the many from the 30’s.

Luis Arroyo is a former Bank of Spain economist. He writes for www.consensodelmercado.com.

Be the first to comment on "This is how the US Fed could help Europe"