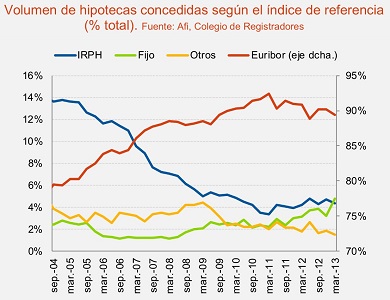

Some 8% of all mortgages in Spain are linked to the IRPH rates or mortgage credit reference index. But from November this year, this index will be put out of use as the banking restructuring process advances. In its place–unless there is a clause stating otherwise–lenders will apply the 12-month Euribor rate adjusted to the spread that there has been during the life of the loan.

What would be consequences? Afi analysts explained Thursday in a report that there will be a double impact. Borrowers will notice their mortgage costs ease because the Euribor reference has consistently be lower than the IRPH, and entities will see their interests margin trimmed. By how much? €610 million or so.

The following chart shows the amount of mortgages following different references.

This information is INCORRECT. The government of Spain is “cooking” a transition regimen that states that the mortages without an explicit sustitution index will be referenced to a new “IRPH entities” plus a diferencial calculated with the entire life of the loan, resulting in a continuity of the mortage costs, or in some cases even an increase.

In the above mortgage related article. After the bank bailouts still no one is questioning that any mortgage that was originated with less than 20 % down had Mortgage Insurance.

Intreresting how nobody questions that its like the Banks got to double dip so to speak, and got money on both ends. With HARP, and other loan programs Mortgage loans appear to be getting fair for all.