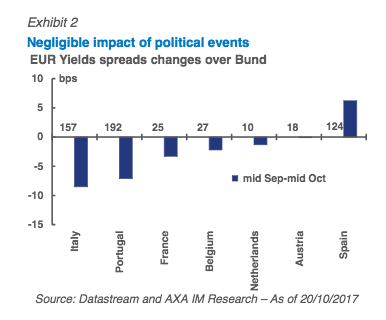

Over the same period, Eurozone spreads moderately tightened, except for Spain and Austria where political events and elections have dominated the scene, although with limited impact on markets so far.

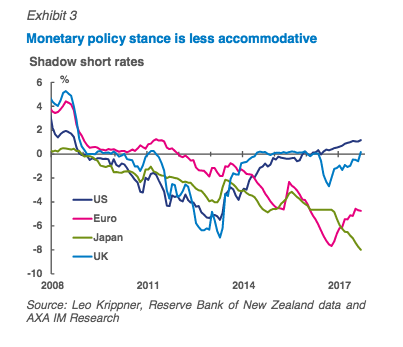

Risk of global contagion from European bonds Economic growth is currently synchronised, across the globe, and short term shadow rates –which take account of central banks’ quantitative easing programmes – are signalling a less accommodative policy stance (except for Japan).

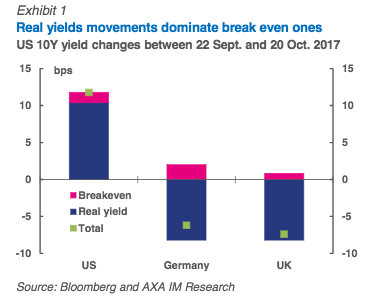

More tightening is expected, starting with yesterday ECB announcement and the BoE hike in November. However, the market is struggling to see this as a catalyst: real yields currently trade close to their year -to- date averages and inflation break -evens are roughly stable. According to AXA IM experts that is because important issues are still pending on several fronts .

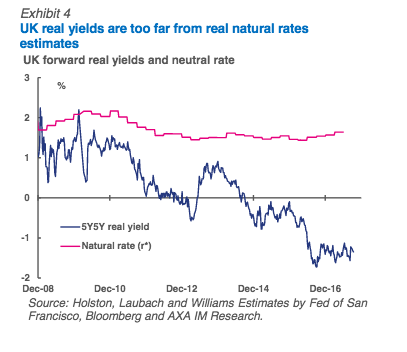

In the US , tax reform, debt ceiling negotiations and the possible announcement of a new US Federal Reserve ( Fed ) Chair all loom on the horizon, while in Europe Brexit and the contentious negotiations surrounding it remain a key open issue. On the inflation side, data releases in U S and Euro area disappointed expectations. The gap between macro fundamentals and market pricing looks widest in the UK. The September rise in bond yields has not lasted long and current valuations look expensive when compared to fair value. And, under our base case scenario of moderately higher short term interest rates, we see two BoE hikes between now and mid -2018, which we expect to increasin g fair value. UK break -evens are slightly above their long- term average, but the valuation gap between real yields and the most recent estimates of the natural interest rates is at an all -time high.

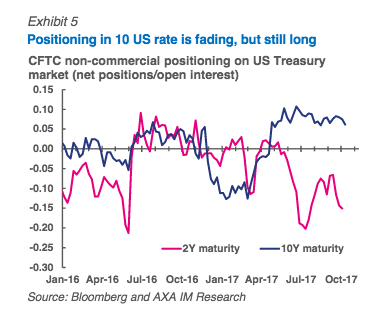

Sentiment in core markets remains split. Speculative positions in US two year rates suggest that the market has turned more hawkish over the past month, increasing short positions. But, while the momentum is fading, long positions in the 10 year rates continue to prevail in the market, something that has been happening since May.

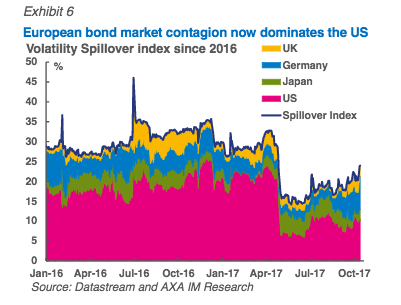

Primary dealers’ data conveys a similar picture, as does the rise in correlations between the performance of Commodity Trading Advisors funds and bonds. The mood surrounding peripherals is slightly positive according to the J .P . Morgan client survey. More recent rumours about the ECB announcing a recalibration of its asset purchase program in favour of smaller monthly purchases , while at the same time extending the programme’s timeframe more than expected, have been also supporting peripherals’ outlook. From a technical perspective, bond volatility contagion has increased since last summer. Interestingly, the individual countries’ contribution shows that the weight of European markets (the sum of UK and Germany, 45%) in the index is higher than that of the US (42%), which is contrary to historical mean.