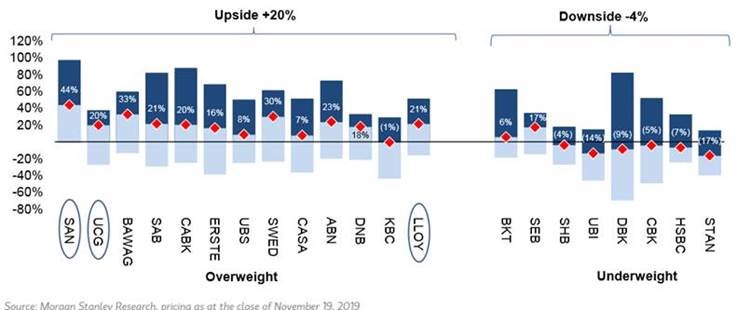

Last week Morgan Stanley analysts upgraded the European banking sector to a buy rating, in step with in-house strategists.

In their “European Banks: At a turning point? Final 3Q wrap-up+Strategy announcements into the YE (21 Nov 2019), the Morgan Stanley analysts explain that interest rates are still low but seem to have reached their bottom and that they don’t expect any further cuts to depo rates. Due to that they expect yield curves to slope upwards as greater macro-economic stability is gradually achieved. All this makes them feel confident that yields will reach their bottom in the 2H19 (although they expect only a 1% increase in yields in the next two years). Also, shares are at an all-time low and offer good returns.