Spiralling again, the eurozone crisis has got most of the old continent winding around Cyprus’ default threat. But for all the hot air rapidly moving in many disparaging directions, nobody can yet tell whether the common currency area is approaching its first breakup or gradually receding from sceptics’ fatal forecasts. The perplexity for some analysts is that at its centre, it whirls a quite insignificant bill–by European Union measures, anyway–of €5.8 billion, which the Eurogroup wants the little country to pay up front before its national rescue takes place.

Will Cypriot parliamentary parties soften their stance against taxing bank deposits? Could a minority government (with the support of just 20 MPs out of 56) manoeuvre skilfully enough to reach a wider accord over an alternative, viable plan? We will probably not know the answers within this week. Russian authorities may lend in special terms to the Cypriot government, or the Cypriot state pension fund may end up hit by the Treasury using guarantees of future profits from gas sales–one of the most important exports of the island. Also, Brussels could relax its conditions if signs of contagion to Italy and Spain arise to the surface. There are rumours aplenty.

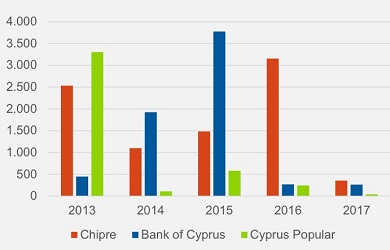

What is clear, though, is that by 2017 the two largest Cypriot banks–Bank of Cyprus and Cyprus Popular–face debt repayments of €11 billion or 86 percent of the whole economy’s output.

And we know, too, that public debt per GDP in Cyprus sits at almost 90 percent, while market credit stopped being an option too long ago. In the coming four years, the state will need €8.5 billion in cash to honour maturities and coupons–some €1.4 billion should already be paid in June.

“It is safe to assume that, unless there is an agreement, access to bank deposits will be blocked,” Afi experts said in a report Wednesday, in Madrid. So that’s one more thing we know. What Brussels should be aware of, though, is that “for the third day, the Cyprus crisis has punished Europe’s equity markets and peripheral sovereign bonds,” as Link Análisis in Spain explained. It added: “The possibility that Cyprus leaves the euro area has affected the financial sector, too. This is not a crisis linked to the economies of other euro country members, but it nevertheless causes further loss of investor confidence.” Exactly, something the eurozone careless leaders must still learn to avoid.

Other countries in the European south and beyond should heed the lessons of the bitter experience of Cyprus with its banking and fiscal crisis that brought down its economic edifice, like a house of cards. Avoiding Cyprus’ mistakes can make the difference between a sustainable economic model or a casino-type economy with easy riches alternating with economic collapse.