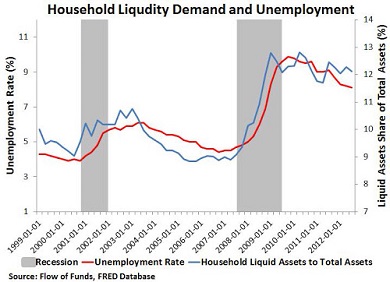

Is there any link between the speed of money circulation–which is the reverse of demand for money and credit– and the real economy? Check the answer this chart gives us.

The blue line is the ratio of liquidity US households retain over their total assets, and the red line would represent unemployment rates. I would say that, indeed, there is a clear relation between liquidity protection behaviour and economic slowdown: the more preferential liquidity becomes, the wider the lack of confidence spreads and the lower investment and employment figures fall.

When crisis comes, households save more, and particularly save more liquidity. This triggers a contraction in consumption, which causes drops in investment. Yes, I know I just said that, but the problem is that I have the impression that almost everyone else doesn’t want to admit it.

In the last two crisis suffered in the US, demand for money increased while the money was being kept in their pockets, reducing speed of money circulation. In the aftermath, demand for money drops followed by unemployment rates.

We cannot afford to tire to repeat this simple correlation again and again. Why? Because the eurozone is trapped in internal conflicts that prevent the European Central Bank to compensate, as it should, the fluctuations of money demand. The most rational mechanism to be implemented would be an expansionary monetary policy, so demand for money is satisfied and cash circulates. Austerity priests and the central bank warn that such move would generate inflation, but the reality is that unused resources have reach staggering levels and our GDP lingers well below its potential.

The graphic, by the way, comes from US economist David Beckworth, who tells us here that the Cyprus crisis is one more symptom of the unbalances within the European common currency area. The euro sure looks hopeless.

Be the first to comment on "Where’s the ECB when the euro needs it?"