UK political turmoil is likely to persist into early next year. A political stand-off appears to be developing, with PM May delaying bringing her deal to a Parliamentary vote and the Labour Party lodging a vote of no confidence in her party. Both developments risk more extreme Brexit outcomes. And both look set to materialise only as the 29 March deadline comes closer. Ultimately, May’s deal represents a compromise of the vague objectives for Brexit. However, Brexit has never been about compromise and with both sides of the debate envisaging different outcomes to the process, neither appear about to make concessions now. PM May looks likely to face an uphill battle to pass her deal through Parliament, while the risks of the process being officially delayed beyond the 29 March deadline have grown. Correspondingly though, with Parliament now able to exert some direction on the future path of Brexit, there appears less of a chance of a chaotic Brexit in March.

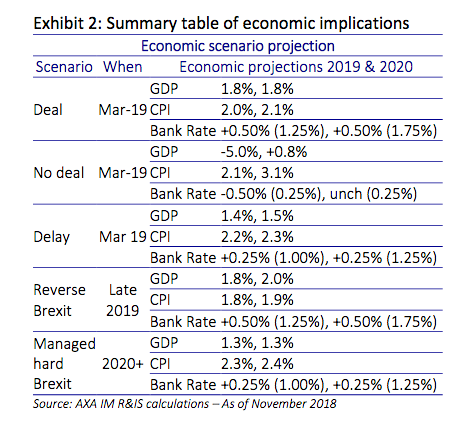

In this context, analysts at AXA IM continue to see the ‘most likely’ outcome as a compromise, similar in substance to the current Agreement. However, with the May’s no confidence challenge and the surprise ruling by the ECJ, the prospect of a chaotic Brexit appears to have receded somewhat. Moreover, the prospect of the UK’s separation from the EU not being resolved by 29 March 2019 (the current Article 50 deadline) has increased. The figure below summarises the range of economic scenarios we now consider possible. Following the experts at the firm briefly describe each scenario.

Accept the deal. The median forecast for now remains an outcome based on a deal, similar in nature to the current Withdrawal Agreement. Importantly that includes a transition phase of at least 21-months, but it is highly likely to be considerably longer, where the current framework of trade with the EU is unchanged. On this basis, it is expected business investment to rebound, helped by the certainty of avoiding a no-transition exit, which is likely to release some pent-up investment demand. It is also expected an appreciation in sterling to reduce the inflation outlook, despite building domestically generated inflation pressure, which should support household spending. Finally, a government spending to rise relative to previous commitments, in line with Chancellor Philip Hammond’s 2018 Budget Statement.

Accordingly, AXA IM forecast GDP growth to accelerate to 1.8% in 2019 and hold there in 2020, notwithstanding deceleration in the broader global economy. We expect inflation to fall back towards target, forecasting inflation at 2.1% in 2019 and 2.1% in 2020. We also forecast the BoE to hike rates twice in 2019 (to 1.25%) and twice more in 2020 (to 1.75%).

Leave with no deal. As the ultimate default scenario, the risk of a “no deal” Brexit persists. This is likely to have the most damaging short-run implications. it would be expected a material impact from a further erosion of business confidence, an inflationary drop in sterling weighing on consumer spending and a reassessment of government spending priorities reducing modest fiscal easing to all reduce demand growth. However, anlaysts are also wary of the supply-side impact of such an outcome, with port capacity to handle all imports as it currently handles non-EU imports limited. This type of shock would be unprecedented in UK or comparable international recent histories. The BoE’s recent analysis suggests a 2% to 8% immediate reduction in GDP associated with the loss of a transition phase, before assessing the longer-term implications.

Accordingly, it is forecast a material 5% reduction in GDP growth in the first 12-months after such an exit. The pace of activity thereafter would depend upon how quickly the UK could rebuild supply-side capacity, which is unknown. Analysts at AXA IM project a relatively quick rebuild, which allows growth to stabilise in 2020 and may make some considerable recovery in 2021. In this scenario, inflation is likely be broadly similar (2% in 2019) to the base scenario. However, as the effect of another large expected sterling depreciation feeds through to consumer prices, they expect CPI inflation to average 3.1% in 2020 (peaking around 3.5%).

The BoE has stated that given supply-side erosion and pound-related inflation pressure it may have to tighten monetary policy. This is a risk. However, so long as inflation expectations remain broadly stable and there are signs that supply-side constraints are likely to be removed relatively quickly (over quarters not years), the BoE is likely to judge the medium-term demand loss to exceed persistent supply loss. Accordingly, it is forecast the BoE reducing the Bank Rate in this scenario by 0.50% to 0.25% by the end of 2019. It is expected it to restart QE shortly after.

Delay. The ECJ ruling makes it easier to delay the “ticking clock” that has ticked relentlessly since the UK government invoked Article 50 in 2017. This can now be achieved without unanimity from the remaining 27 countries, but by unilateral decision. This increases the probability of the UK still being in the EU beyond March next year. Yet from an economic perspective this continues the post-referendum purgatory. The avoidance of hard Brexit is a good outcome from an economic perspective. However, the persistence of the uncertainty that has surrounded Brexit will continue to dampen economic activity. The short-term elimination of a chaotic Brexit in March, should reduce downside risks to sterling, resulting in some appreciation (though not as much as in a deal situation). In turn this will help inflation drift lower, being somewhat supportive of household spending. Moreover business investment is likely to persist at its current modest pace. AXA IM forecast GDP growth to remain around current rates, forecasting 1.4% and 1.5% in 2019 and 2020 respectively. Inflation is likely to be modestly firmer at 2.2% and 2.3%. However, the BoE recognising a softer pace of activity for the economy, is likely to tighten policy a little more cautiously. It is forecast one rate hike each year.

Because a “delay” is not a long-term political solution, the short-term implications of the ultimate end-game in this scenario.

Reversal of Brexit – most likely via a second referendum. In the short-term this outcome would be consider to be a similar but more exaggerated version of the no deal scenario. A recovery in business investment and sterling should underpin a pick-up in UK GDP growth to 1.8% and 2.0% over the coming years, despite slower global activity. Nevertheless an expected faster pick-up in sterling than in a “deal” scenario would likely see inflation moderately lower (forecast of 1.8% and 1.9%), which would likely see the MPC tighten policy at a similar two hikes a year pace. This scenario is likely to prove materially more beneficial than other scenarios over the longer-term and depending on the political background in the UK over the ensuing years, the UK may start to attract foreign direct investment at a faster pace, which would help mitigate the effects of any global deceleration, as well as help boost the outlook for long-term productivity growth.

Managed no deal. This would be an exit based on WTO arrangements but one for which the UK had prepared, to avoid the material supply-side impact of leaving without transition in 2019. The ultimate costs of such an exit would still be large (HM Treasury estimates an average 7% reduction in GDP over 30 years). However, this would avoid the 2% to 8% of GDP short-term impact that the BoE assesses the consequence of no implementation phase for now. In this scenario, the short-term economic implications are relatively second-order, the UK would likely still be in the EU in 2019 and 2020 (preparing/re-negotiating). Business investment would still face ongoing uncertainty over the timing and type of exit, although it would avoid a sharp no transition exit and would be able to anticipate the needs of a harder Brexit. Sterling would likely see a further modest depreciation in anticipation of rising trade barriers. In all we forecast a modest 1.3% growth in 2019 and 2020 (unchanged on our expectation for 2018). However, the longer-term supply-side deterioration associated with a WTO arrangement is likely to lead to modestly faster inflation, which the BoE would likely have to meet with modest monetary policy tightening. Analysts at AXA IM forecast this at one hike per year.