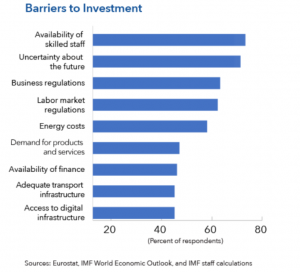

Interesting this graphic from the IMF referring to the barriers to investment.

From greater concern about the risk of bottlenecks in qualified employment, the uncertainty over the future of the Union, regulation and energy costs to less preoccupation about adequate financing, infrastructures and digital transformation. In light of the challenges it faces at the moment, Europe needs a solid and agile financial sector, so that it can achieve complementarity amongst banks which provide the best funding and financial services at an adequate cost. At the same time, a deep and integrated capitals market is required.

The improvement in profitability remains one of the main goals for the European banks. And they are tackling this with a combination of strategies which range from adjustment and consolidation in the sector to greater efficiency via a digitalisation process determined by the client. In its report, the IMF highlights the adjustment of nonperforming loans accumulated during the crisis, via a process which makes them compatible with growth in new financing which is greater than the nominal growth of the European economy itself.

To all the above we should add the sustainability of the growth, taking into account the challenge of climate change which we have to face as a society. The banks are essential for financing prosperity and so have a key role to play in making possible the combination of high growth today without jeopardising future generations. And within a context of economic inclusion which is distributed to the whole of society.