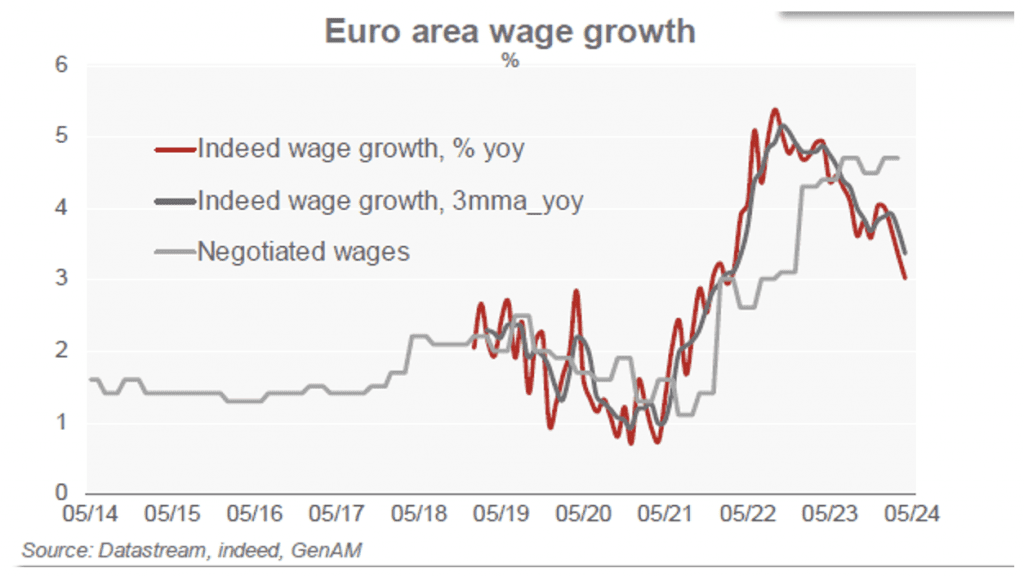

Martin Wolburg (Generali AM) | Markets remain concerned in the home stretch of the fight against inflation that central banks should only reluctantly ease rates. Recently, ECB Governing Council members such as Schnabel and de Guindos warned about wage growth developments as an upside risk to inflation. Last week, German official wage data for the first quarter (+6.2% year-on-year) pointed in that direction and, at the eurozone level, negotiated first quarter wage growth strengthened to 4.7% year-on-year.

That said, the German data are exceptionally boosted by one-off tax-free payments to compensate for the past pick-up in inflation; wage growth in France, Italy and Spain was only around 3% year-on-year.

Looking ahead, the wage growth indicator based on job vacancies points to a moderation in wage dynamics at the beginning of the second quarter (to 3.0% year-on-year in April). The ECB’s own indicators suggest that negotiated wage growth will be around 4% in 2024 (down from 4.5% in 2023).