Bankinter: Inflation has fallen significantly and more than expected in September. The General Rate stands at +4.3% against +4.5% expected and +5.2% previously. In the month-on-month comparison, inflation has risen more than expected,+1.7% against 1.3% expected and +0.2% previously. The Underlying Rate, which excludes the most volatile items of the indicator, stands at +4.5% against +4.8% expected and +5.3% previously.

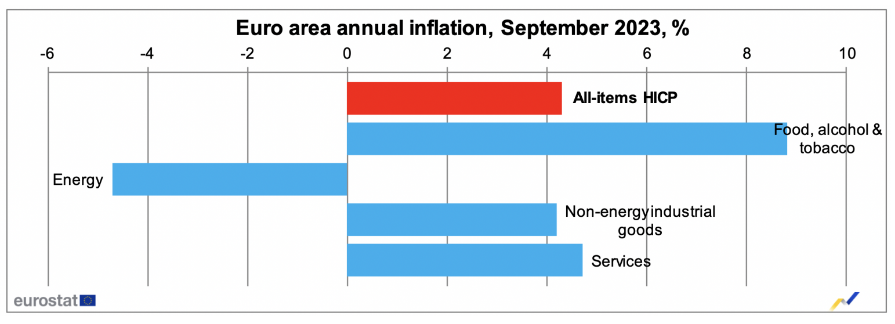

By components, energy is the one that has most contributed to the deceleration of the General Rate (-4.7%). However, food and tobacco have gone up +8.8%.

Positive data. More controlled rates in the price level take pressure off the ECB to continue tightening monetary policy. The reference rate currently stands at 4.00%/4.50%.

The market impact is positive. Bond yields are easing as a result of lower inflation expectations between -8bp (in Germany; 2.85%) and -12bp (in Italy; 4.75%). This supports stock markets. The EuroStoxx has rallied +0.6% and the Ibex-35 +0.4%. The euro +0.5% against the dollar (1.061), little has changed after the release.