Morgan Stanley: The construction sector (SXOP) trades at a premium in line with the 10Y average, not reflecting the increase in returns the sector has seen since 2018. According to Cedar Ekblom, 12M forward ROE SXOP/SXXP is 12% versus the 10Y average of -1%.

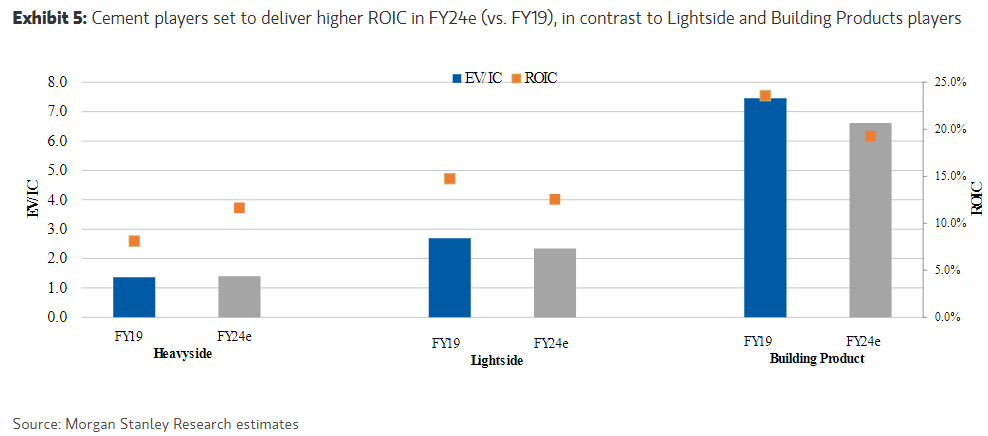

Within the sector it is noted that the discount in valuation weighs more among heavyside companies, which trades at 11x P/E (-19% discount vs historical) against an in-line valuation of lightside 21.5x P/E. The analyst team compares the ROIC of heavyside vs lightside between 2019 and 2024e, estimating a +250bps increase in the former, versus -220/-430 (lightside and building products), a contrast that is not reflected in the valuation. They therefore identify stocks with higher sector potential in Heidelberg (Overweight), Buzzi (Equalweight), Saint-Gobain (Overweight), and Wienerberger (Overweight).