Caixabank Research |Monetary policy has reacted quickly and decisively to the COVID-19 pandemic. However, having successfully played the role of «fire-fighter», the ECB will have to remain highly active to support the revival of the economy. In just four months the ECB has increased the size of its balance sheet by more than 1.6 trillion euros (+35%), as much as it did in the entire four years of the global financial crisis and the euro area’s double recession of 2008-2012. It took four years (2008-2012) to do so then.

This assertive action has focused on three major spheres: (i) defusing financial stress and restoring the proper functioning of the markets; (ii) ensuring the abundance of liquidity and favourable access to credit for firms and households, and (iii) anchoring a low-interest-rate environment that provides cover for the actions of fiscal policy. As we shall see below, all this has been achieved with an extensive and aggressive battery of measurements.

The COVID-19 outbreak not only triggered a sharp and severe tightening of the financial environment, but it also jeopardised the transmission of monetary policy throughout the euro area. This risk was especially visible in the sovereign debt markets, with significant spreads emerging between yields. Nevertheless, the euro area periphery began to suffer capital outflows due to international investors taking refuge in the core countries. In particular, the financial accounts for the balance of payments show that, in March and April, international investors were net sellers of peripheral debt and net purchasers of core debt, with net outflows from the periphery representing just over 0.50% of GDP in March and around 0.25% in April.

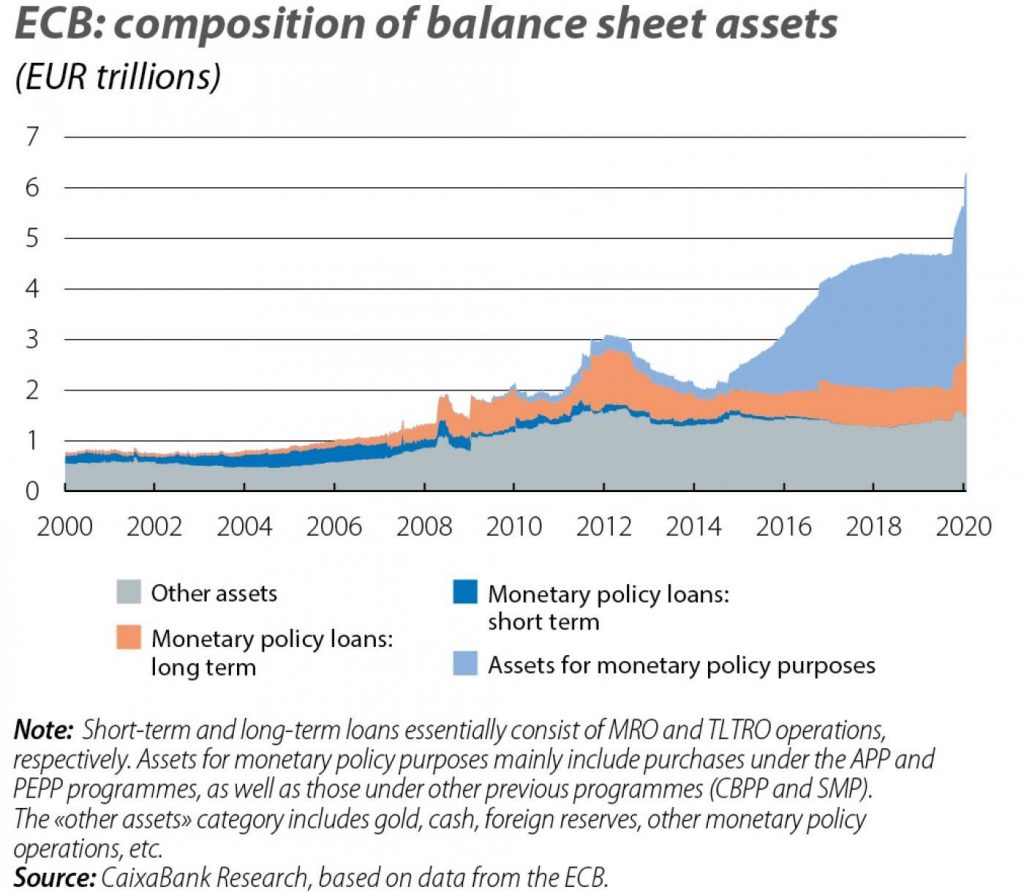

In the face of this double onslaught, in addition to keeping official rates at record lows, the ECB’s rapid action focused on launching abundant and recurring injections of liquidity with very favourable conditions (with weekly LTRO, monthly PELTRO and quarterly TLTRO-III auctions), as well as buying up large amounts of public and corporate debt (under the APP and PEPP purchasing programmes). These actions help both to reduce financing costs and to ensure liquidity in the markets (and thus the proper functioning thereof).As the first chart shows, in just four months the ECB’s loans to the financial sector increased by almost 1 trillion euros in net terms (they account for 60% of the total increase in the balance sheet and account for 25% of all ECB assets). Furthermore, in the same period public and private debt assets worth around 550 billion (or 33% of the total increase in the balance sheet) were acquired, of which some 385 billion fall under the PEPP and 165 billion under the APP. Thus, purchases of public and corporate debt now account for 50% of all the assets on the ECB’s balance sheet.

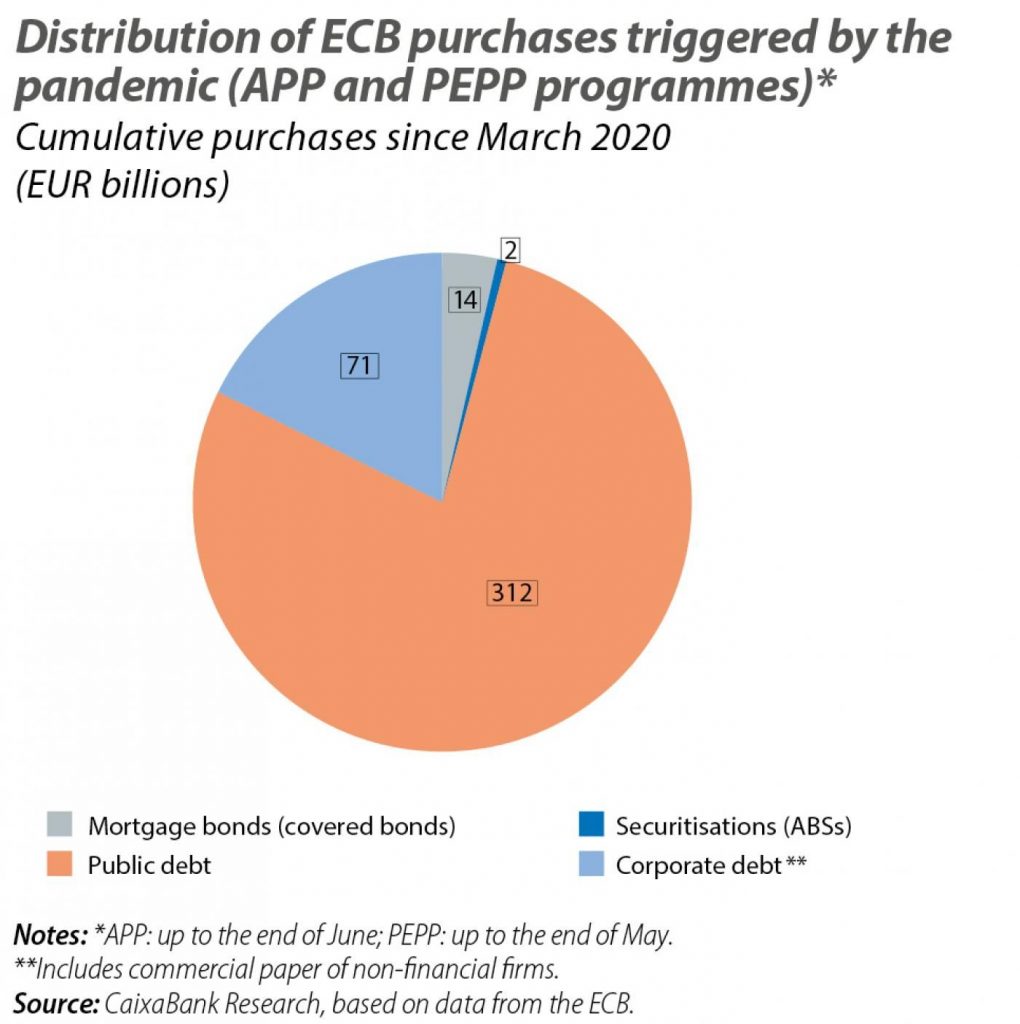

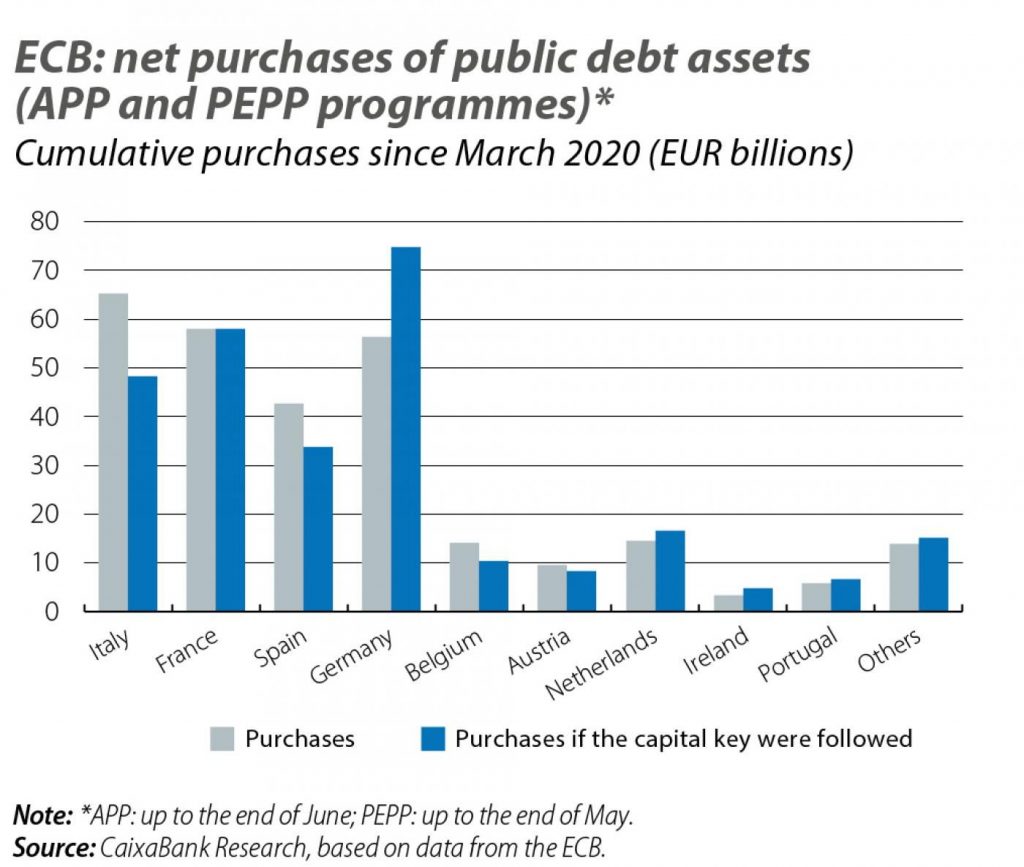

The asset purchases have been dominated by the acquisition of public debt in secondary markets (see second chart), given that sovereign bonds are a key benchmark in the financial markets and allow the ECB to transmit the reduction in sovereign rates to all other asset classes. In other words, with this measure the ECB sought both to relax financial conditions across the board and to ensure the proper transmission of its monetary policy to all jurisdictions and markets. Precisely for this second purpose, the ECB has had to skew its purchases in favour of certain assets: as the third chart shows, it has bought proportionately more peripheral debt than core debt, with a particular focus on Italian debt. However, purchasing volumes are very high in all jurisdictions, to the extent that the demand for sovereign bonds indirectly generated by the ECB could absorb around 75% of the euro area’s public financing needs in 2020-2021.

On the other hand, the second chart also shows that, in order to more directly protect the business sector’s access to finance, the ECB has made significant purchases of corporate debt, thereby ensuring liquidity in the corporate bond and commercial paper markets. In this regard, it should be noted that a significant portion of these purchases have focused on very short-term corporate debt (indeed, the ECB reduced the minimum maturity of eligible commercial paper within its corporate purchases from six months to 28 days).

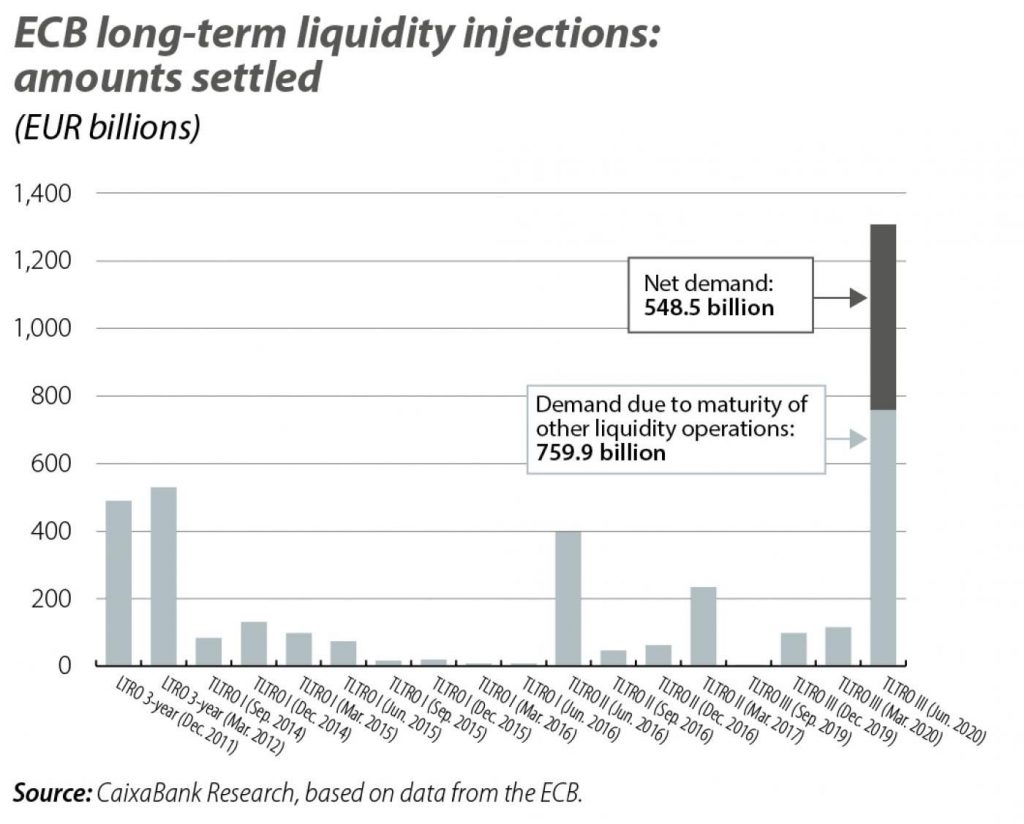

Finally, the ECB also took measures6 to protect the financial sector’s access to the liquidity injected through refinancing operations (the LTRO, PELTRO and TLTRO-III discussed above). Thus, these measures and the improvements in the conditions under which the ECB is offering its liquidity injections explain why the June auctions generated record demand, far in excess of any other long-term liquidity auction ever carried out (see fourth chart). This not only helps to make the financial sector more resilient and to ensure that lending to firms and households continues to flow with favourable conditions (the ECB charges lower interest rates to banks that do not reduce their eligible loan portfolio), but it also indirectly helps to maintain a low-interest-rate environment (both by generating excess liquidity and by inducing indirect demand for sovereign bonds).

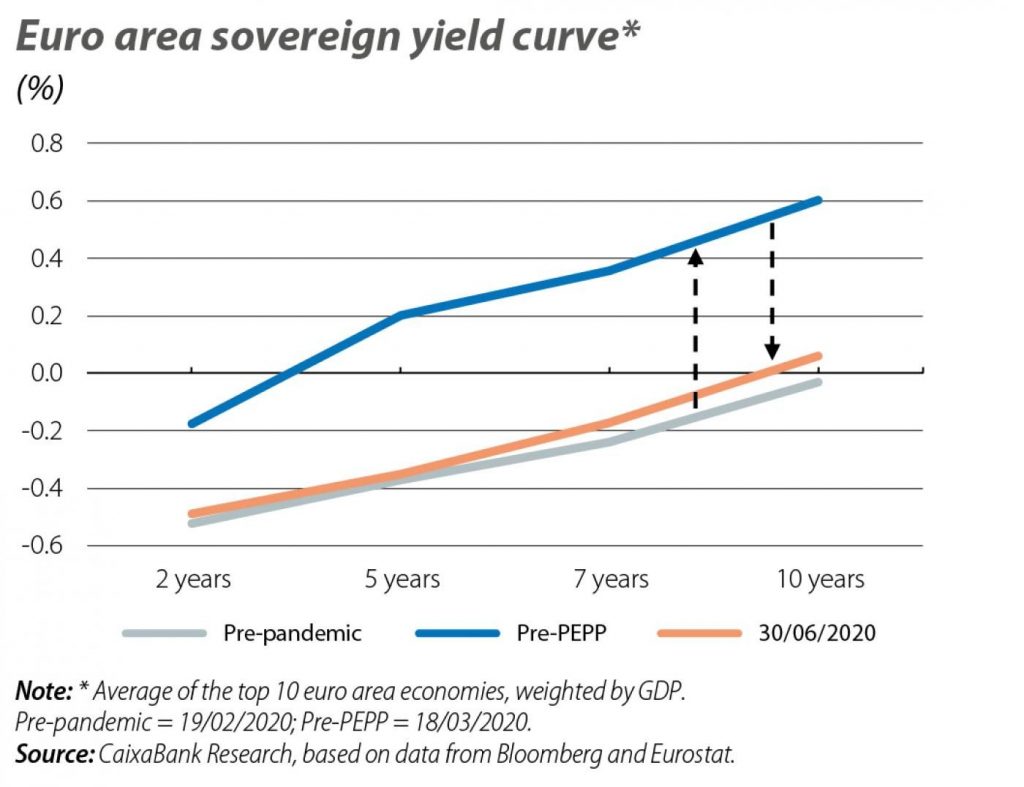

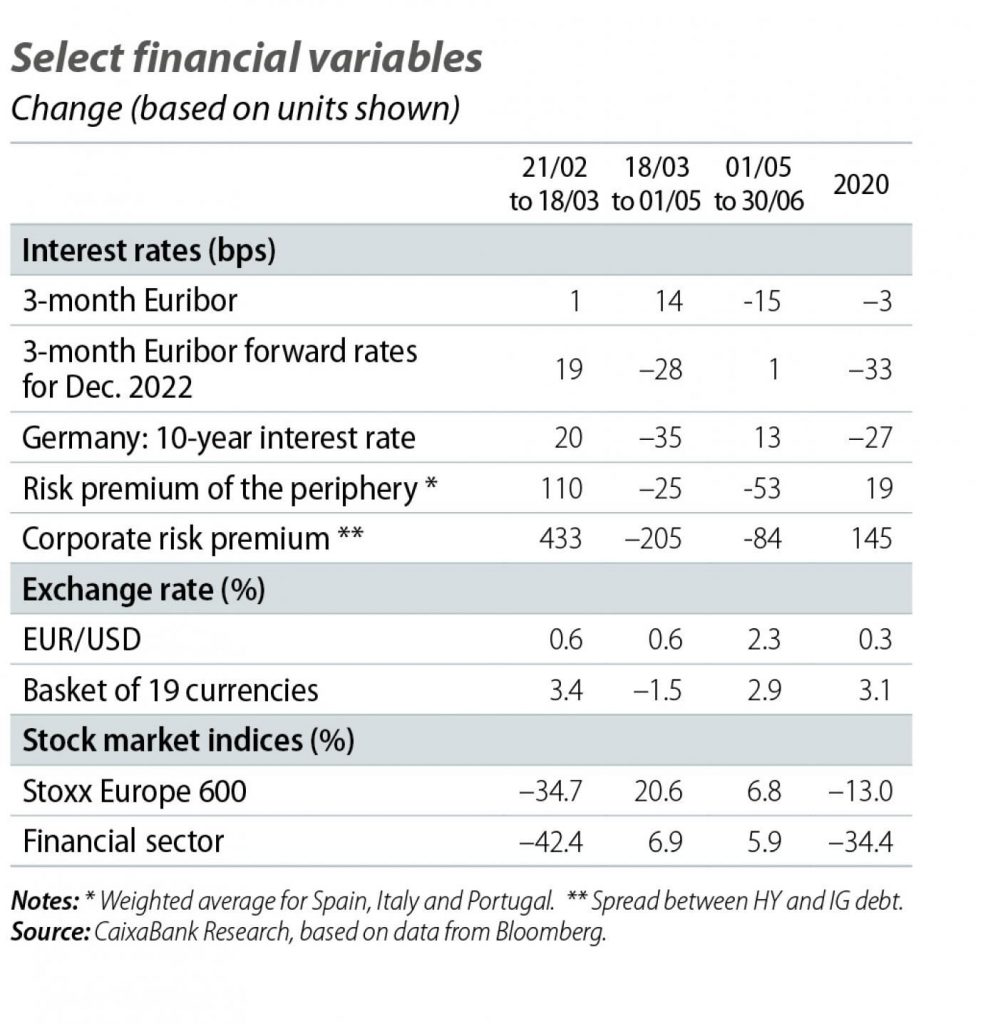

The last chart and the table show how, following the strong initial turbulence (i.e. until mid-March, when the ECB launched the bulk of its measures), the ECB’s speed and decisiveness succeeded in defusing financial stress (interest rates have fallen steadily, both for sovereign debt and for corporate debt and interbank lending, while the stock markets have gradually recovered), as well as in anchoring a low-interest-rate environment for a long period of time (see the change in the 3-month Euribor rate expected by investors in December 2022).

However, the economic and financial environment is highly demanding (for instance, the stock markets remain well below their levels of the start of the year, while risk premiums remain significantly higher). At this juncture, the ECB may leave the role of “fire-fighter” described in this article, which it has performed successfully, behind it. However, all the indicators suggest that, in the absence of a vaccine or an effective treatment against COVID-19, the economic recovery will remain incomplete in the coming quarters. Therefore, the ECB will have to remain highly active in order to sustain a favourable financial environment that supports firms and households and provides cover for the necessary action of fiscal policy.