The market for warehouses over 5,000 square metres recorded a strong activity in Germany throughout 2011 and returned to growth in France and in the United Kingdom. The disparity between second hand and new premises is widening in most countries since demand is mainly turned towards high-grade premises.

According to a BNP Paribas Real Estate research, even though the market has been vigorous during the past few quarters, supply levels have remained high and developers are still unwilling to start new speculative schemes. As a result rents only increased marginally throughout Europe.

In Germany, the market has been thriving since the beginning of the year, recording some of the highest quarterly take-up volumes over the past 10 years. The market was particularly boosted by some significant deals with on line and retail businesses. In some locations, availability of new high-grade premises has become limited and occasionally led to rent increases.

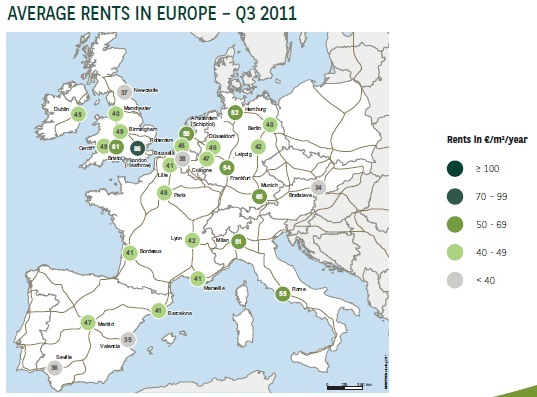

In France, the market enjoyed a slight recovery overall. This was more evident in the 4 major market sectors serving the North-South axis where take-up increased by 22% during the first three quarters compared to the same period in 2010. Supply has started to decline in Q3 2011 but still remains high. Prime rents have not grown over the past few quarters, ranging from €43 and €53 in Greater Paris, and between €42-44 in Lille, Lyon, and Marseille.

In the United Kingdom, after a slow start for the year, take-up for Q3 2011 has been the highest recorded since Q3 2009. Supply remains high in most locations but situations of under supply for certain size bands have been emerging in some markets. The Midlands (Birmingham) have accounted for one quarter of the total take-up recorded in the country. London Heathrow has the highest prime rents across Europe.

Warehousing investment decreased significantly in most West European countries by more than 20% in the first 9 months of 2011 compared to the same period in 2010. Investors continued to show signs of risk aversion and opted for more secure assets in the most liquid markets and sectors, offices in particular.

The United Kingdom represented 45% of total warehousing investment in Western Europe followed by Germany (22%) and France (16%). Net prime yields have remained fairly stable since the beginning of the year standing below 7% only in Germany and London.

Be the first to comment on "European warehousing investment concentrates in the UK"