Germany was the main beneficiary, with practically zero growth in exports during the same period (0.3% inter-quarterly). On the other hand, consumption remained stronger despite the acceleration in inflation, which reached 1.7% over the year and a high of 2.1% in the third quarter, and despite the fall in household confidence. This last point contrasts with a marked fall in unemployment, which fell from 9.1% to 8.2% in 2018, benefiting from a buoyant labour market in which the demand for skilled labour remains high.

GDP growth could slow to 1.4% in 2019

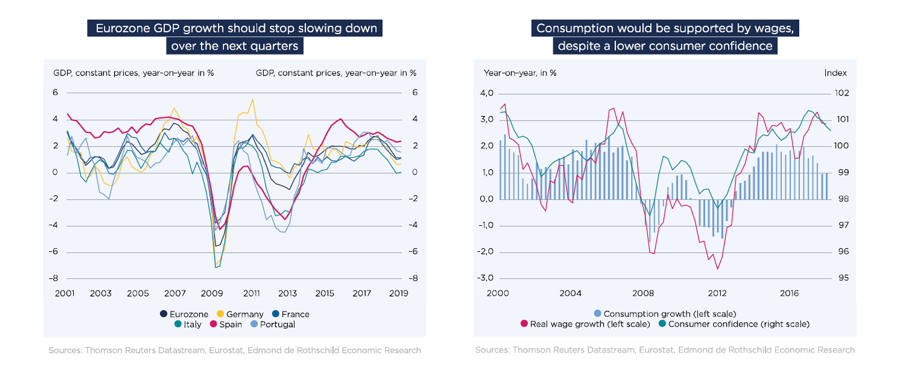

Eurozone GDP growth reached 1,2% yoy in the first quarter of 2019, still weighed down by weak export growth. Nevertheless, we observed an encouraging recovery in growth in the first quarter, up to 0.4% inter-quarterly growth. In particular, this recovery can be seen in Italy, which ended a period of two successive quarter with negative growth, and in Germany, with an inter-quarterly growth of 0.4%, following contraction in the third quarter of 2018 and stagnation in the fourth quarter. Growth in the construction sector has accelerated to 5.0% during the first quarter 2019 in the Eurozone, and up to 7.2% in Germany, which makes this sector a key factor in expansion. Eurozone growth should start again based on public and private consumption. We expect it will reach average of 1.4%, exceeding yet again the potential growth estimated at 1.3%.

Consumption will be supported by an increase in purchasing power

Growth in private consumption will increase from the second quarter onwards and will reach an average of 1.4% in 2019. This will be sustained by an increase in purchasing power as a result of increasing real waged in an ever more buoyant labour market. In addition, government measures to increade purchasing power should encourage even more consumption in 2019, especially in France, where expected spending announced in response to social protests already amounts to 13 billion euros (in other words, about 450 euros per household on average, particularly favouring the middle class). In Spain the minimum wage was increases 22% on 1 January (to 900 euros). In Italy a citizens´ wage was introduced in April (for a total of 7,1 billion euros in 2019, 7.8 billion in 2020 and 8 billion in 2021), as well as employment incentives. Lastly, in Germany, changes in the social security system (reduction of unemployment contribution from 3% to 2.6% from 1 January and in the tax system (increase in household fiscal deductions from 1 January, which will increase again from 1 July 2019 and again from 1 January 2020) should strengthen purchasing power. However, the effect of this increase in purchasing power on consumption will be limited by a savings rate which has already increased rapidly to 12.4% in March 2019, compared to 11.6% the year before. It is likely that this increase is due to the fall in household confidence, as well as low inflation expectations, which limits household short term expenditure on consumption. In addition to these adverse effects, there could also be a cyclical slowdown in the consumption of durable goods, especially France.

Public spending should remain significant

Public spending should increase in 2019, reaching an average growth of 1.8%, supported by the fiscal expansion projected in various countries in the region. This is particularly true of Germany, which should invest 150 billion euros over four years in infrastructure, education, housing and digitalisation. In France there could be an increase in public spending in the second half of the year due to the changing behaviour of elected officials in the run-up to local elections in March 2020. The expenditure related to intermediate consumption and wage increases mean an automatic increase in public spending. In Portugal, on the other hand, it is likely that public spending will increase only slightly as the Government seeks to rebalance the budget.

Investment and exports should moderate

It is expected that growth in investment in capital goods will fall to 1.4% in 2019, due to the increase in uncertainty. This is based on, firstly, at international level, on the slowdown in the global economy, as well as the ongoing trade conflict and on the risk of a no deal Brexit. Secondly in the Eurozone itself. The results of May´s European Parliament elections and their short and medium term implications could encourage companies to delay certain investment projects. In addition these investments could be reduced due to the toughening of companies´ margins, limited by wage increases. As for investments in construction, the growth could slow slightly to 2.7% in 2019. It will be supported by low interest rates, as well as public spending, specially in Germany. Investment in construction in Portugal is expected to be supported by the housing market, which continues to grow strongly. The growth in exports could fall again to 2.5% in 2019, due to the slowdown in global demand, as well as the risk that the trade disputes provoked by the US intensify. Imports should grow 3.2% in 2019, close to 2018, sustained by the increase in purchasing power and public spending. The difference between trends in imports and exports will generate a trade deficit, which will contribute negatively to GDP by -0.2 percentage points in 2019.

The labour market should remain buoyant

Unemployment should continue to fall to 7.6% by the end of 2019, due to the continued high demand for skilled workers. This will allow a gradual increase in nominal salaries. The increase will only impact slowly and gradually on inflation, especially in a context of moderate acceleration in household spending due to greater savings rates. Inflation is expected to reach 1.5% in 2019, compared to 1.7% in 2018, which will further increase purchasing power.

Growth in 2020 will also remain stable

Growth is expected to stabilise in 2020 at 1.4%. Household consumption will grow slightly, less than in 2019, to the extent that the effects of favourable policies, especially in France, begin to disappear. Public consumption should slow, due to the reduction in support for fiscal measures. Imports are expected to be less solid, depending on the evolution of private and public financing, and the trade balance should improve slightly, with a contribution to growth of -0.1 percentage points. Unemployment should stabilise at 7.6%. Finally, inflation is expected to be 1.5%.

Political risks will persist

A no-deal Brexit would have a moderate impact on Eurozone growth, with a fall in exports of 0.6 to 0.8 percentage points over three years. A new agreement on Brexit is expected to be debated in June. A new increase of US tariffs on European cars would have a negative effect of 0.4 percentage points on Eurozone growth, but with important disparities between countries. Germany is likely to be badly affected, with a fall in growth of 1.2 percentage points, which would provoke a recession in the country. It is to be feared that this would produce contagion effects in other countries in the area. President Trump should take a decision on the changes in tariffs in the middle of November 2019