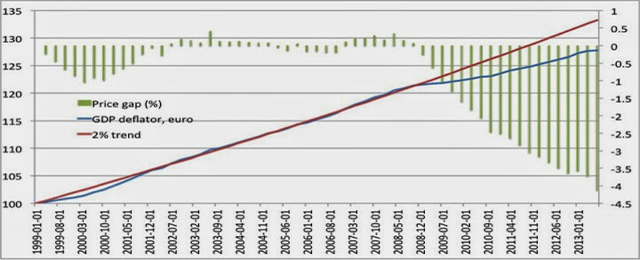

The chart above (from Market Monetarist) shows the deviation in price levels, which increased since the ECB didn’t meet the 2% inflation target. Doubts among market agents grew by 4%, and thus such deviation got bigger.

Draghi announced three brilliant measures: first, lowering the interest rate from 0.25% to 0.15%, which is virtually a zero interest rate. What we don’t know whether this will be enough to encourage investment and to create employment. Lowering interest rates may be very effective or it can lead to the so-called “Zero Lower Bound,” a.k.a. liquidity trap, in which the natural interest rate of full employment is negative in several points and in which the central bank cannot exceed such limit.

In order to strengthen this measure, the second brilliant measure was establishing a negative or penalized interest rate to the deposits that banks keep in the ECB. The aim is to activate the credit flow, since from now on accumulating liquidity will have a cost for them. But… which cost? The cost estimate is the difference between the interest rate in obtaining liquidity (0.15%) and the cost of depositing it (-10%); i.e. a 0.25% net cost.

The problem with such a measure is that it doesn’t adjust to its ultimate purposes. Denmark’s Bank had a negative interest rate, but its goal was avoiding the strong capital inflows in the Danish central bank (in that time when markets trusted more in the Danish currency than in the euro).

However, the ECB’s aim is quite different: it wants for banks to increase theirs credits and customer deposits –i.e. the money supply- to limit disinflation (and potential deflation).

Now, banks don’t lend because there is no credit demand with enough guarantees, that is, with a reliable collateral. Furthermore, banks are limited by a regulation that forces them to increase capital versus assets (and there is no much capital, neither private nor public).

In Europe there is a further restriction: monetary and fiscal regulation that limits the potential salvation of banks. Basically, it is difficult to thing that a penalization so low will be enough to force banks to give credit.

Moreover, banks may look for other riskless and more profitable havens to keep their liquidity, as Mr Mackintosh says at The Financial Times.

The third and last brilliant measure is the announcement of a new LTRO with €400 billion for the banking system, which represents around 7% of their loan portfolio. It is similar to the one launched by Trichet, although they have changed its name to TLTRO. So this is a substitution, not an added value, and it won’t be sterilized. Nonetheless, this is not the same as the QE.

The following chart shows a comparison between the efforts made by the main central banks.

The problem is that the ECB didn’t maintain the asset acquisition during the crisis. On the contrary: it got rid of most of those assets, which led to a disastrous impact on the economy.

The ECB finally decided to redirect its destiny in 2012. Now, the key question is finding out whether what the ECB has done is enough. Mr Draghi said these measures won’t be all the ECB will do, that there will be more to come (and many market agents loved this possibility).

Let’s admit that Mr Draghi has reached the limit imposed by Germany, which lets the ECB act with delay and in dribs and drabs (“behind the curve”). And just FYI: Germany won’t let them use the heavy artillery if it is not too late.

These measures will not mitigate the southern economies in the euro. In Spain, bank credit keeps falling, and what Mr Draghi announced on Thursday will not be decisive to change this trend. To sum up: the Eurozone is not an Optimal Currency Area at all. What Spain needs is the ultimate salvation of its banks and specially of its credit channel, because otherwise money won’t reach its final destination.

Be the first to comment on "Draghi, still behind the curve"