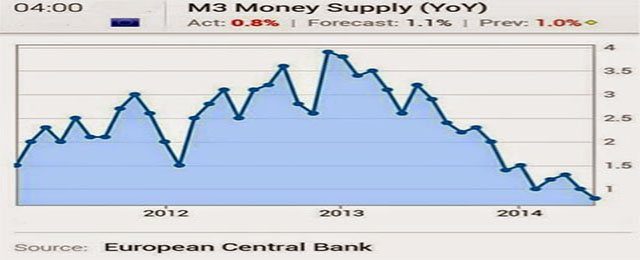

The lack of banking credit currently reduces the money supply in the euro zone. This is why some financial analysts think ECB’s next expected action essentially relaunches lending. Money supply is the liquid counterpart of banking assets, and its level basically depends of credit to non-financial sectors.

The ECB does not want to indiscriminately “water” it, so that it is expected to take separate measures leading to stimulate financial entities for money lending. With this aim, the central bank could take several decisions: to open long-term credit lines subjected to SME’s financing; to cut official interest rates now standing at 0.25%, and to punish deposits that banks keep in the ECB with a negative interest.

Any move will mean a relief, but it is very difficult they achieve to reactivate the euro zone’s economy. That the Fed could have done the same – to turn into negative deposit rates- has been much discussed. Market Monetarists trust this measure’s efficiency. However, saving the risk premium, which must be very high considering the difference between private banking rates and debt rates in some countries, would need a quite significant reduction of depo rates. Anyway, it seems not enough to face deflations risks, whose expectations increase the distance between nominal and real interests rates.

With inflation estimate of 0% in next years, households income would hardly grow. If aiming to encourage families and companies to increase their spending and get into debt, interests they pay would have to be reduced to a big extent.

It is worth to wonder if the priority is to push credit ot just to generate expectations of moderate but sustained inflation. This involves to rise the amount of money in circulation. However, if the credit channel is obstructed due to banks troubles, no matter how much entities may boosted, they will continue to be far from the adequate solvency conditions needed to operate properly. This fact makes the option of opening credit lines for SME’s less feasible. The money would reach spending units in dribs and drabs.

What the ECB should do is to massively buy public debt, removing it from financial assets for the banks to find fresh liquid assets as well as capital gains to cover its holes and thus cut interests of private sector’s credit. It is supposed that once the debt reaches a very low interest rate, banks will be concerned by other operations.

It would be really surprising to see such a move from the European central bank. The most probable option is it tries to cajole markets with measures that pass Germany’s “nihil obstat”, together with words of confidence assuring the ECB’s arsenal is full of weapons.

Be the first to comment on "Looking forward the ECB’s relief"