Obviously, it can be said that the ECB’s only mandate is inflation. Another way to say it is that the fall in inflation is due to structural problems in the European economy. Thus, the ECB’s performance is a key factor in limiting the negative impact of the crisis and allowing time for the political authorities to combat its root causes. However, the latter is not easy. Why not, you may wonder. Firstly, because of the aforementioned structural problems. Do you know the answer to these problems? I’m sure you don’t. Neither do I. In fact, we have lived through these problems over an extensive period of time and plenty of suffering. And, unfortunately, we still don’t have all the information so as to assess the issue as a whole.

Let me try and give you a perspective of the crisis development so far. Pardon me for my daring, although it won’t be too thorough. It is, after all, for efficiency reasons: I mean to reach conclusions.

“Lack of integration”… Do you remember? This was the argument offered to justify the crisis that engulfed several countries in the Eurozone suffered between 2008 and 2012. The euro had a design flaw because the monetary convergence wasn’t accompanied by a real (and financial) convergence. You will be familiar with the rest of the story: many countries suffered drastic internal adjustments due to financial restrictions, structural reforms and fiscal adjustments. The consequences were adjustments in the price of assets, the improvement of competitiveness and cuts in the structural public deficit. Did these measures solve the problem? Unfortunately they did not. On the contrary, more problems appeared.

Social and political tensions have become a recurring theme since then, making it more difficult to progress towards European integration. At the very least, integration has reached a point in which the actors can now afford an impasse, all the while waiting and hoping that better things will come.

“Systemic risk”… Do you remember the debate about the survival of the euro? It reached its peak in mid-2012, when the ECB assumed the role of euro guarantor. In this context, the term “financial stability” appeared, and it became the goal that would grant enough flexibility for the European monetary authority to purchase public debt if necessary.

The famous OMT was not used, though. The ECB’s willingness to use it to fight financial speculation in many countries of the euro area proved to be more than enough. The “positive contagion” or “Draghi dixit” led to a sharp drop in risk premiums, which in turn, significantly improved the financing conditions of affected countries. Actually, it improved the conditions of the whole euro area. It was an appreciable advance towards risk mutualisation in the Eurozone.

Besides, the ECB adopted new liquidity measures, while at the same time reinforcing a decline in interest rates. Despite all this, the European economy has stagnated.

“Under potential growth”… Is this due to the deterioration in the labour market during the crisis? It is really difficult to quantify the level of potential growth as well as to anticipate its future development. It is apparently as simple as determining productivity levels, levels of investment and the consequent size of the workforce. There is a different way to tackle this: to implement structural reforms that will increase flexibility in production, improve training and provide greater visibility to the future development of the economy. Obviously, it is also necessary to halt the steep drop in the workforce, which leads to migration and discouragement. And, of course, let´s not forget the improvement in financing. But the ECB is in charge of that. Yet the outstanding issues may not be so easily remedied.

Now you have to put all the previous items in the context of limited global growth and the continued adjustment in internal balances (both private and public, and also in debt). Let´s not forget geopolitical uncertainties (yes: in plural). How do you see it? I already know your answer: take it slow and easy. That is precisely the same prescription the ECB has offered in its decision-making. The market does the rest, induced by an oratory policy that is increasingly aggressive and anticipates the limitless expansion of monetary intervention into the future. But such intervention must now be unconventional, because orthodox methods have been tried and almost been exhausted.

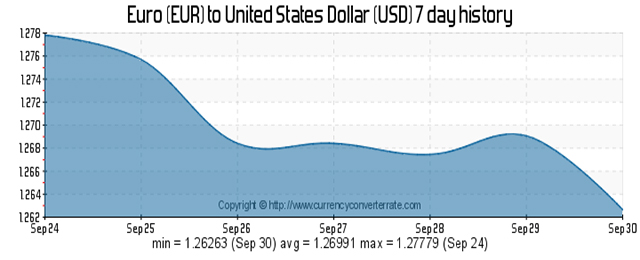

Investors’ response was naturally saw a decrease in the value of the euro. In Asia, the Bank of Japan has committed to reaching 2% inflation, which will be possible thanks to a combination of monetary and fiscal measures and an exchange policy which will depreciate the yen.

In the Eurozone, the ECB has not shown an inclination to force depreciation of the single currency. However, the potential positive impact of such depreciation on inflation has been calculated many times. And it has also been calculated in the political sphere, which focused on an improvement in competitiveness and a recovery in exports. In both cases, the theoretical depreciation calculations are larger than the euro fall registered until now (slightly less than 5% in nominal effective exchange rates from maximum levels of 2Q14).

Would it perhaps be better to see this drop doubled in the future? Perhaps an even greater drop is desirable, so as to reach new minimum levels since the beginning of the crisis. This is our forecast, at least.

Will this finally be the solution for the European crisis? In Japan it was not. But, obviously, Japan’s problems are different from ours. Yes, they are. They are probably minor problems.

Be the first to comment on "IN DEPTH: Is low inflation the greatest problem for the European economy?"