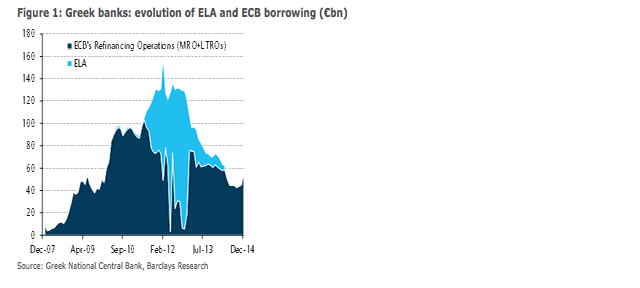

-In 2012, one third of the Greek balance sheets were financed by the ECB, and most via ELA. Cyprus reached 30% of the balance sheet and at the worst of the times Ireland too, with similar magnitudes.

-In November 2014 11% of Greek lenders’ balance sheets were financed by the ECB although with usual collateral, not seeking ELA.

-After the deposit outflows in December, and according to the latest data from the ECB, the funding level on total assets rose to 14%.

-Many media are reporting thatdeposit outflows in January have been much greater than in December.

Barclays research team commented on the ELA usage:

“The usage of ELA declined significantly in the second part of last year to almost zero after having peaked €107bn in October 2012. The ELA borrowing seems to have increased over the past few days. No official data by the Greek National Central Bank for January are available yet. However, an indication of the ELA usage in the Eurosystem comes from the data in item 6 on the Assets side of the Eurosystem’s weekly financial statement (where ELA operations are normally accounted for). This item was broadly stable until January 23, suggesting no significant usage of ELA by then, but it has increased by about €3.5bn in the week ending 30 January, suggesting some usage over the past few days.“

Also:

“The ECB does not provide any details on which banking systems take ELA liquidity, but we suspect that some Greek banks with a shortage of ECB-eligible collateral might have taken it, given the ongoing deposit outflows and the deterioration of market funding conditions. Regarding the ECB’s regular refinancing operations, as at the end of December, the ECB borrowing amounted to about €56bn (of which €49bn at the MRO and €7bn at the LTROs). we suspect that the increase in the MRO borrowing at the Eurosystem level from about €100bn before the end of last year to the current level of €152bn is probably due to higher demand for ECB liquidity from Greek banks that still have ECB-eligible collateral.”

Be the first to comment on "Pressure on Greek debt: A nudge or a punch in Athens’ face?"