- Purchases under the program will start on March 9.

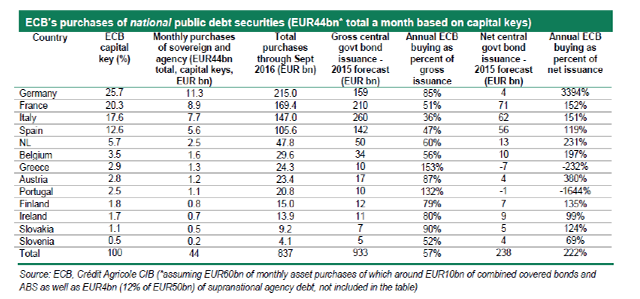

- Purchases will total €60 billion per month.

- The ECB will purchase debt with negative yields, so long as those yields are not below the ECB deposit rate at time of purchase. The ECB deposit rate is currently -0.2%.

- If a Euro-Area central bank cannot purchase sufficient marketable debt instruments to fulfill its allocation, the ECB will allow substitute purchases. This substitute purchases rule should enable the ECB to fill its €60 billion target each month.

- The ECB will not buy more than 25% share of any one issue in order to avoid it having a blocking majority in case of any debt restructuring.

- The ECB will only buy in the secondary market.

- The ECB will purchase debt with remaining maturity between 2 and 30 years only.

The ECB provided a list of the international and supernational institutions and agencies it would purchase the debt of:

-

- Council of Europe Development Bank

- European Atomic Energy Community

- European Financial Stability Facility

- European Stability Mechanism

- European Investment Bank

- European Union

- Nordic Investment Bank

- Caisse d’amortissement de la dette sociale (CADES)

- Union Nationale Interprofessionnelle pour l’Emploi dans l’Industrie et le Commerce (UNEDIC)

- Instituto de Credito Oficial

- Kreditanstalt fuer Wiederaufbau

- Landeskreditbank Baden-Württemberg Foerderbank

- Landwirtschaftliche Rentenbank

- NRW.Bank

Be the first to comment on "Memento: How QE will work"