French elections will likely serve as a way to take the populism temperature, as well as being the next step towards de-globalisation. As the Dutch general elections showed, the populist drive may prove to be not as strong as anticipated by the polls. But most of the media is presenting the French elections in this way. Furthermore, it has to be considered the fact that the pollsters underestimated the force of populism last year in the UK. “In other words, recent history has shown that pollsters are seemingly ill-equipped to capture the intentions of frustrated voters,” explains Markus Allenspach, Head Fixed Income Research at Julius Baer.

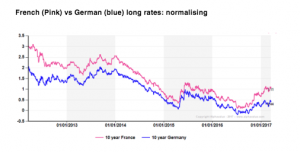

Therefore, “markets can only keep an eye, with debt markets at the forefront as any hint of a Frexit would translate into widening spreads”, says analysts at Carax- Alphavalue. The picture of the gap between German 10-year rates and the French ones certainly denotes increasing caution but not much more than that, at least from a 5-year perspective. The widely-expected reduction in bond buying from the ECB may be as big a contributor to the current 70bp spread as (still distant) fears of Mrs Le Pen. Experts at the house add:

“In any case, even with a “normal” government, France’s balance sheet is such a mess that the spread contraction of 2015 was bound to be transitory.”

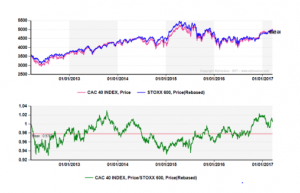

Looking at the price indices of the CAC40 (as CAC does not allow for dividends) and the Stoxx600 shows that one would be hard pressed to see a serious bout of fear developing on French equities. Even the French banks which would be the first victims of a populist win have recovered from their last February bout of weakness.

On the other hand, Philippe Waecher Chief Economist at Natixis AM compares the faltering trend growth between US and France since the 2008 financial crisis. Currently

A large proportion of this decline can be attributed to the deep recession that took place between fall 2008 and spring 2009. However, even if we set aside this period, trend growth is still weaker than before the crisis. Average annual growth in the US has stood at 2.1% since hitting a low in 2Q 2009, while in France this figure is 1.1%, which is still well below figures enjoyed pre-crisis.

Economists analyze this downturn in growth but cannot agree on the factors that triggered this trend.

The first explanation from Kenneth Rogoff) attributes this weak growth to the macroeconomic adjustment in the aftermath of a severe financial crisis. The crisis is the result of a build-up of private debt on a specific asset (real estate).

The second argument by Larry Summers suggests that the period of slow growth reflects the

The third approach given by Olivier Blanchard is based on the role of pessimistic projections

“These three interpretations of the economic cycle are not complementary but they all feature

Adopting an excessively restrictive fiscal strategy means taking the risk of failing to fuel demand and being stuck with slow-moving growth. Against this backdrop, implementing structural reforms does not seem to be the way forward either,

In view of the factors outlined, it is vital to take the

This is a major challenge for France as the presidential elections draw near. It is vital to bear in mind the various dimensions of the French economic cycle and avoid dogmatic attitudes if the country’s economy is to be set on the right track for the next five years.