J.L.M. Campuzano (Spanish Banking Association) | An interesting study from the ECB about the structure of the financial sector in Europe shows the increasing weighting in the non-banking financial sector’s assets and the consolidation carried out by the lenders.

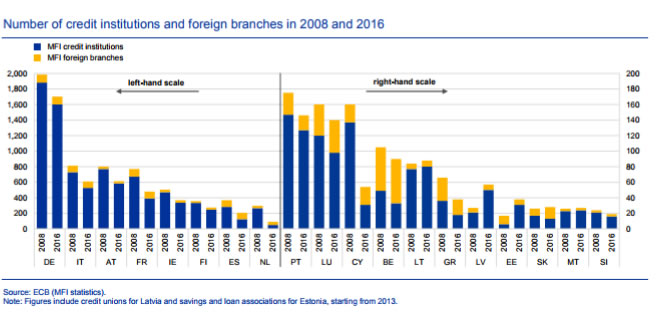

The European banks continued their consolidation process last year, going from 5.474 institutions in 2015 to 5.073. In 2008, there were more than 6.768 credit institutions in the Eurozone. The total volume of assets last year was 24.2 billion euros, a drop of 14% compared with 2008 levels.

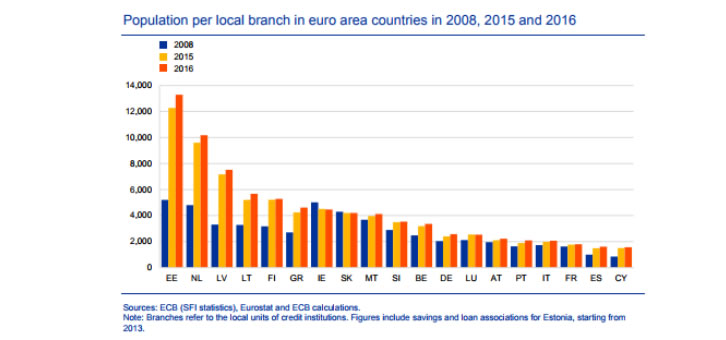

The European banks also continued to cut the number of branches: 20% between 2006 and 2008, a sixth part of that just last year alone. The ratios of population per branch and population per employee were still high last year.

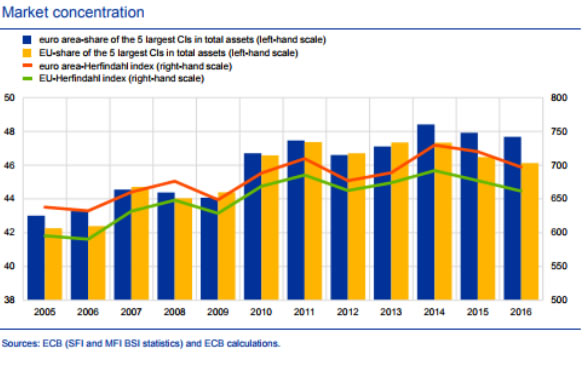

Against a backdrop of unique supervision and resolution, with yields at historic lows,with clients demanding more efficiency, the rationalisation of the sector almost becomes an obligation. But done in an orderly fashion. The percentage of assets per the five biggest European banks has gone from 48.4% in 2008 to 47.7% at end-2017.

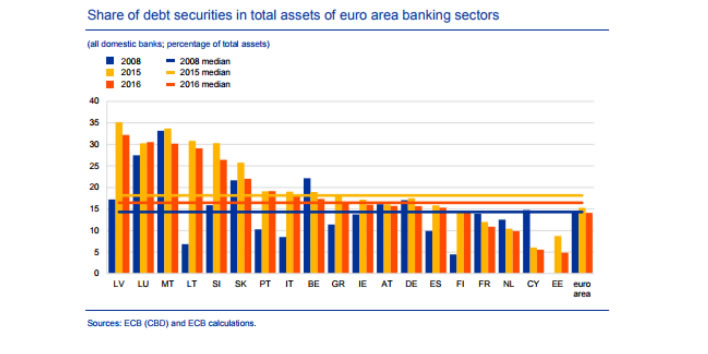

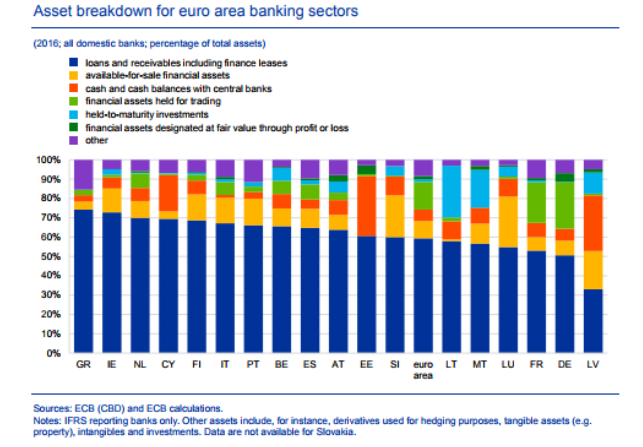

The European banks have continued to reduce the weighting in their portfolio of debt issued in markets, a reflection of the ECB’s asset purchasing programme as part of its QE policy.

This has been offset by the increased weighting in their balance sheet of loans to companies and households, reflecting the importance of the banks in the financing of economic growth in Europe.

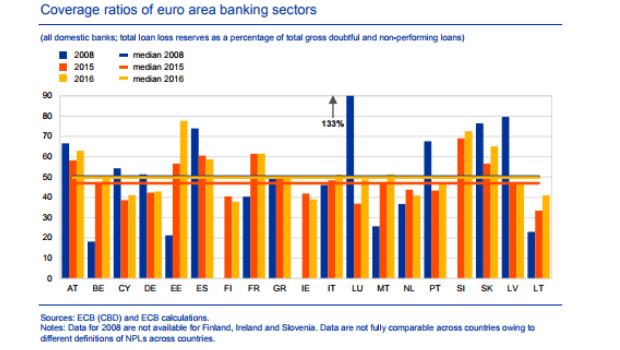

The NPLs ratio remains one of the most important challenges for the European lenders. That said, last year they continued to decline, with higher average coverage of 50% versus 47% the previous year.

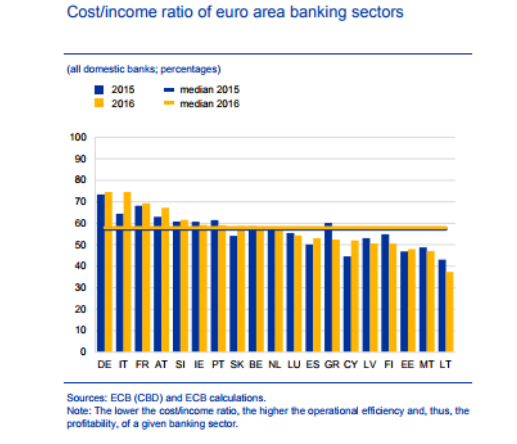

And there is relative stability in terms of the overall efficiency ratio.

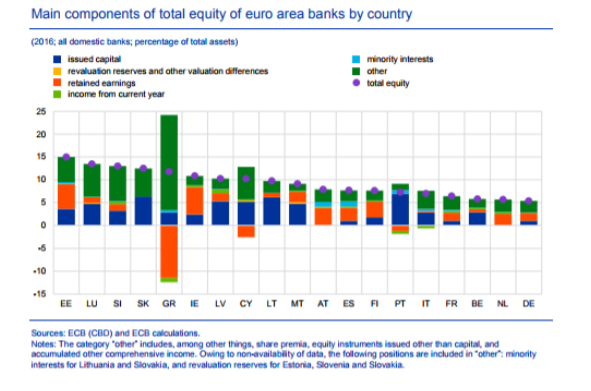

The Tier1 capital ratio reached 16.1% last year, with a CET1 ratio of 15.4%.