There were no big changes in the ECB’s message, but the language was different. In fact, the most important thing about yesterday’s meeting is that the ECB eliminated from its communication its willingness to increase its asset purchase programme (APP) in time and easing bias. This seems coherent with an economic recovery scenario and can satisfy those ECB members more in favour of monetary orthodoxy.

Apart from that, the ECB kept its reference interest rate at 0.0%, its deposit facility rate at -0.4% and marginal lending facility rate at 0.25%, in line with market forecasts. In a note to clients, economists at Morgan Stanley said it doubted that the central bank was about to make the depo rate less negative. At most, they expected a 15 bps rise in the depo in ’19.

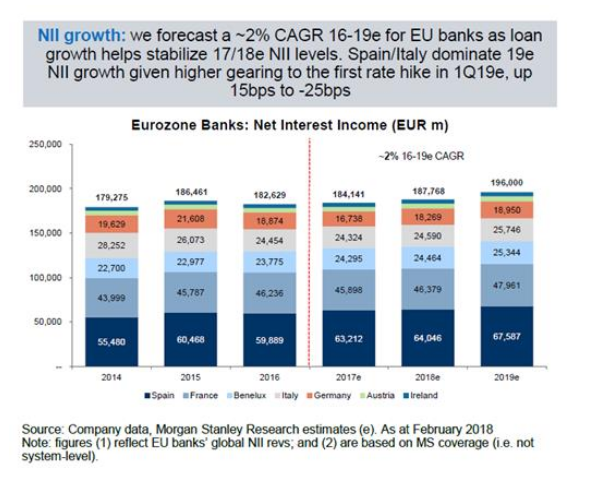

With regard to these comments, the firm’s analysts believe that in an environment of yields increase, the European banks’s net interest income should also rise.

They flagged that Spain and Italy are going to dominate Net Interest Income growth in 2019, with more leverage on the first increases in Q1’19. For that reason, on a European level, the favourites to play the rise in rates are Spain and Italy, despite the fact the normalisation will be long-term. Their analysts prefer those banks leveraged at high rates, especially via their asset base, and specifically believe that those with a long-term franchise of mortgages and deposits will do better.

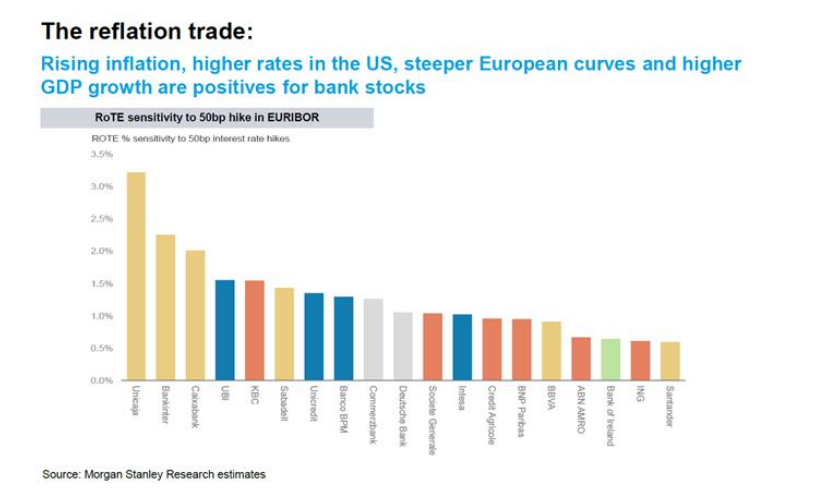

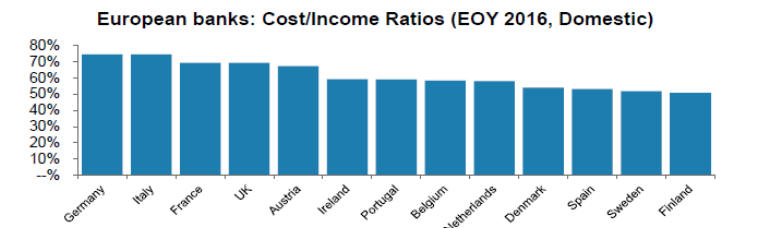

Unicaja, Bankinter and Caixabank are mongst the banks which improve their ROTE more with every 50 bp rise in the Euribor. And furthermore, with one of the most efficient cost structures in Europe, Morgan Stanley highlights. That’s why it is betting on Spanish ideas for the European sector…The analysts recommend a buy on Santander, Caixabank and Unicaja both for Spanish and European funds.

Source: Morgan Stanley research