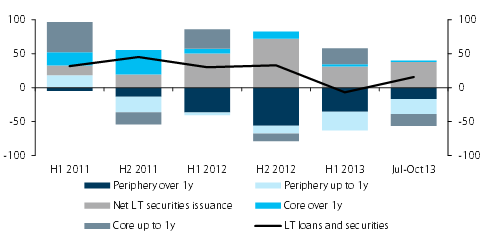

The headline M3 data and lending data were weak, in absolute terms, and versus consensus expectations. Still, looking through the details, it does look like the drag from deleveraging is less intense than before. As shown in Figure 1, about half of the decline in lending this year across the euro area has been in sub 1y loans (and €40bn out of €54bn since July), which are typically volatile, and lag the economic cycle by about nine months.

Figure 1* – Lending to euro area non-financial corporates (adjusted for sales and securitisations, € bn)

The longer-term bank lending to peripheral non-financial corporates is still declining, but by less than before, while the long-term bank lending in core countries remains flat. Importantly, though, total long-term financing to the corporate sector seems to have bottomed in H1: indeed, corporate bond issuance has been brisk, and has more than compensated for the declining bank lending.

Obviously, this move away from bank lending towards capital markets funding is available mainly to larger companies (in both core and periphery countries), and does not benefit smaller companies. It is something the ECB is keen to promote, though, and results in an overall picture of financing that is less negative than the headline monetary data suggest.

The ECB, EIB/EIF and EU have been working on tools to spur SMEs lending: there has been some small progress on the securitisation side, but we do not expect the ECB to announce a LTRO (on SME collateral) yet, or a funding-for-lending-type scheme in the coming few months.

Separately, note that the ECB M3 related data on bank holdings of government debt showed further large declines in Spanish banks’ holdings. In fact, combining this with the Spanish Treasury data (available until end August) and anecdotal evidence suggests that Spanish banks have reduced their government bond holdings (taking profit ahead of the ECB Comprehensive Assessment) by about €15-20bn in H2, reversing half the buying seen in H1.

The flipside of this is that foreign buyers are likely to have increased their holdings, again something supported by anecdotal evidence. All in all, we estimate that foreign buyers by now have been buying around €35-40bn of total Spanish issuance, with domestic banks back down to €15-20bn (total net issuance to end November is €65bn). This suggests that the early 2014 issuance by Spain is likely to be more easily absorbed than many expect, with banks likely to once again play their buffer role, and foreign investors returning slowly to Spain as the outlook stabilises (and, indeed, S&P changed its rating outlook on Spain to BBB Stable on 29 November).

*Source: ECB, Barclays Research

Be the first to comment on "Steady for now: the ECB and the euro area"