During the last part of 2012, the yields on public debt of the most solvent countries (Germany and United States) remained in the zone of all-time lows reached months ago. This situation has continued due to several factors. In the euro area: due to lower growth prospects in 2013, low official interest rates and abundant liquidity provided by the ECB, as well as the uncertainty still hovering over the public debt of periphery countries.

In the United States: due to the uncertainty generated by the lack of parliamentary agreement in order to avoid the «fiscal cliff» and to the pressure exerted by the Fed’s intervention in bond markets. Altogether, these elements have helped to establish a calm environment for those investors prioritizing high quality assets over higher yield and risk assets. The fact that these assets act as a safe haven can be seen in the downward trend of yields for the 10-year German Bund and US Treasury bonds since January 2012. However, as the political risks and economic obstacles on both sides of the Atlantic duly diminish over the coming months, there is likely to be a timid recovery in the curve for these countries’ debt yields.

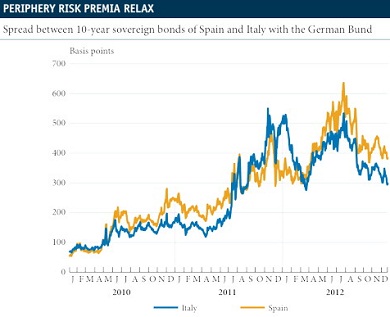

Looking at the euro area, it is a fact that the markets’ perception of the risk of the EMU breaking up has decreased in the fourth quarter of 2012. After the announcement of Outright Monetary Transactions (OMTs) by the ECB, other factors have also helped to improve the situation. Of note is the series of good news regarding the creation of European banking union and the recapitalization of Spain’s financial system with European funds, which have soothed international capital markets.

In December, the payment of another aid package to Greece and agreements at the last European Council meeting have added further positive stimuli to market sentiment. With regard to internal developments in the two key countries under pressure, namely Spain and Italy, there has also been particularly relevant news to bring down their risk premia.

In the economic area, Spain has seen a lower drop than expected in its business indicators. In the fiscal area, the deviation from the agreed deficit target looks like being somewhat smaller after the encouraging figures on general government spending and the announcement of more measures to contain public expenditure. The process of sorting out Spain’s banks has also helped to restore some external confidence, making it easier to sell sovereign debt in the Treasury’s auctions.

However, the immediate future for the sovereign debt markets of southern Europe is still highly vulnerable. Particularly significant are Italy’s presidential elections, Spain’s final budget details and the consequent debate on whether the government should ask the ESM for a precautionary credit line.

Be the first to comment on "The reduction in tail risks eases periphery sovereign debt crisis"