Those advocating the Grexit solution as the best way forward were suddenly silent, as the prospect of a default became all too evident. The European Council praised a rather slender Greek proposal, and some of its members even hinted that debt restructuring could be on the agenda at a later date. An outstanding first round victory for Tsipras. In the days to come, a deal can only be struck on his terms, for all the efforts diehard zealots of orthodoxy might make to fill his basket with extra sacrifices.

It will not be a very painful task to sell a deal back home which involves limited concessions in pre-retirement and taxes in exchange for fresh money to avoid financial collapse. He has failed to secure the debt write-down for which Varoufakis has pleaded in vain during the past weeks. Even if he had a strong case for softening the conditions of ECB and IMF-held debt, the time was far from ripe for compromising on such a thorny issue. Especially when he failed once again to deliver substance on reforms and fiscal discipline.

Forceful ECB interventions have staved off the threat of a huge banking liquidity crunch as Greek residents cashed in their deposits. Such a helping hand when the crisis worsened kept Tsipras alive and allowed him to engage in his final battle reasonably unscathed. The Frankfurt-based monetary authority had little option but to pump money into Greek banks on the verge of utter collapse.

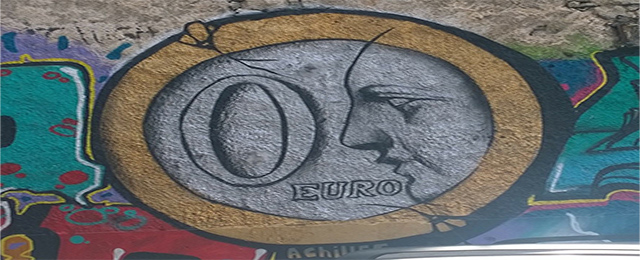

Jubilant markets have hailed the upcoming deal as providing extra time and money to unravel the Greek imbroglio. Their view is that salvaging the dire situation in this country is a key issue both for saving the euro and preventing wild volatility in financial assets.

They might be right, but the price to pay in terms of credibility might bring long-term consequences. If refusal to abide by the law pays off, the discipline within the Eurozone might vanish. It never commanded much respect, but the blow inflicted by the Greek government could encourage others to behave in a similar mode. So bad news for governments implementing tough measures to redress the problem of their battered public finances. And bad news for those who fear that anti-European sentiment might spring up all across our continent, destroying the efforts made during so many years.

A lot of blame could be apportioned to the clumsy way in which this severe crisis has been managed. Yet a complete overhaul of policies, after having fairly combined a stable economy and a socially advanced society in the past, is hardly the best option.

*Image: Foter / Denis Bocquet

Be the first to comment on "Two for the price of one: Salvage Greece and save the Euro for free"