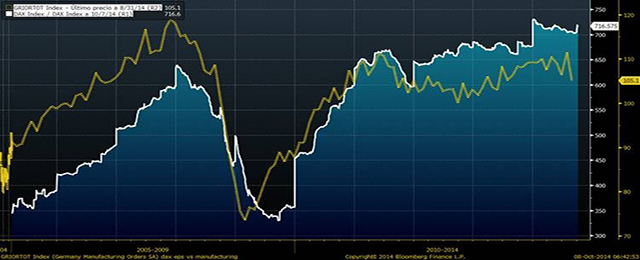

Mr Vigil gives the example of Germany, a role model of exportation, and its sluggish last PMI data. Despite the euro’s depreciation, there is no sign that orders are increasing.

Also, if we check the relationship between DAX performance (white line) and the PMI, it seems pretty high, although it’s obviously not the best comparison since we are considering an index which can represent (or not) the entirety of the country’s economic activity. However, it can give us a hint of what is happening.

Be the first to comment on "A weak euro doesn’t necessarily mean stronger Q3, Q4 earnings"