S&P Global Rating| The European Recovery and Resilience Mechanism (ERM) will boost public investment in Spain and Italy over the medium term. This follows a significant drop in public spending in both countries over a decade.

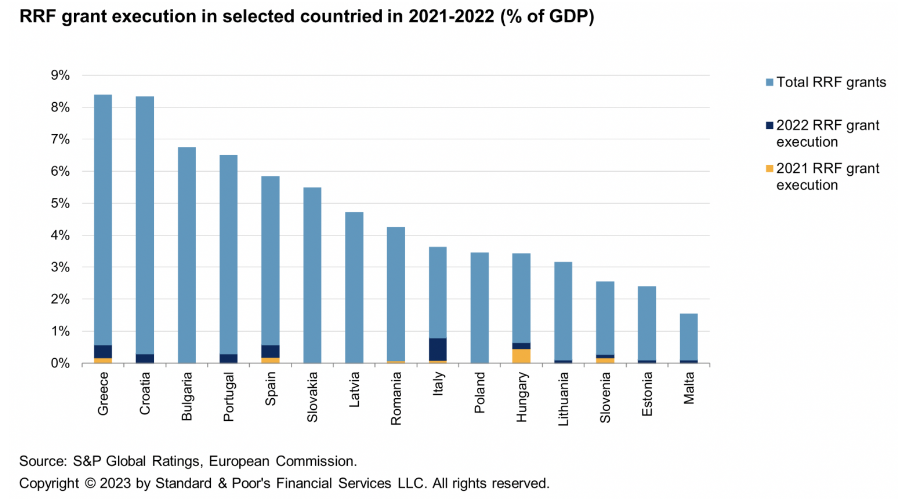

However, the use of these subsidies is well beyond the initial 2026 deadline. We estimate that Spain and Italy had only implemented 10% and 20% of the available subsidies, respectively, by the end of 2022. It seems increasingly likely that these countries, as well as other governments that are benefiting from large EU grants, will ask for more time to undertake complex investment projects that address climate, digitalisation and social cohesion objectives.

In our view, reduced administrative capacity, administrative complexities, including new processes for managing PEF funds, anti-corruption oversight, EU state aid rules and recent high inflation have contributed to these delays.

S&P Global Ratings does not believe that the flows and expenses related to the RRF will affect the creditworthiness of Spanish and Italian LRGs. However, we expect temporary mismatches between accrued revenues and investment execution.