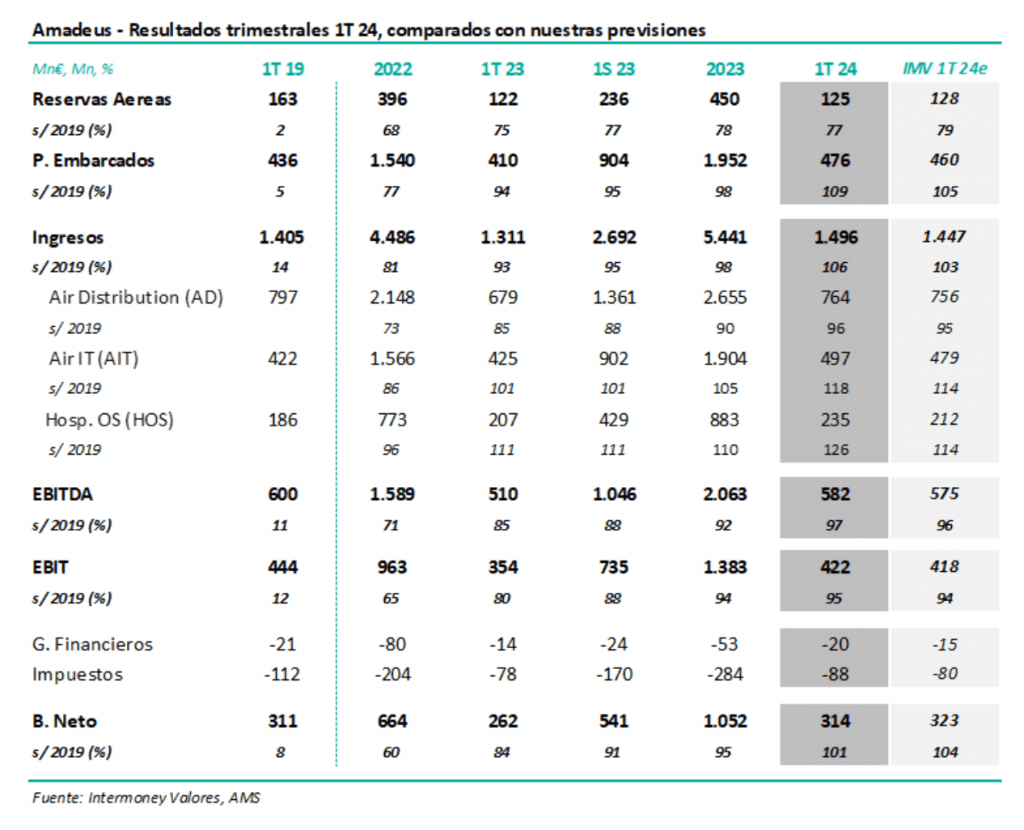

Intermoney | Amadeus (Hold, PO €60) has just released its Q1 results, and will hold a conference call today at 1pm. Last quarter’s figures, which are shown in the attached table, have continued to converge, slowly, to those recorded in 2019, and were slightly above our estimates at the operational level. Air bookings and passengers boarded reached 77% and 109% of pre-pandemic figures at March 24, respectively, compared to IMVe (79% and 105%). This resulted in EBITDA of €582m (€575m IMVe), which represents 97% of the 2019 figure. We confirm our estimates, which we do not change either after the 2023 annual figures, with expected revenue growth at 24e (+13%), right at the midpoint of the company’s guidance.

Bookings (77% of 2019 to March) and passengers boarded (109%), continued their recovery. Amadeus today reported Amadeus air bookings last quarter of $125m ($128m IMVe), or 77% of pre-pandemic levels, which was up just under 1bp from 4Q23. In passengers boarded, Amadeus clearly outperformed IMVe (109% vs. 105% vs. 2019 levels); in 4Q23 on a year-to-date basis, this activity finally matched pre-pandemic levels (100%).

Consolidated revenues were close to €1.5bn at March, or 106% of 2019 levels (103% IMVe). Revenues reflected the recovery in booking volumes and especially PB, resulting in revenues last quarter of €1,496 million, above IMVe, and finally exceeding pre-pandemic levels in this line.

- Air Distribution (AD) average revenue per air booking increased up 9% year-on-year in 23, (6% IMVe) to €6.10 due to the relative mix improvement, and partially due to a favourable exchange rate. Revenues of this business at €764 Mn (€756 Mn IMVe), 96% of the pre-pandemic figure.

- In the case of Air IT (AIT), unit revenue per PB was 5% higher than in 4Q23, exceeding the euro level (€1.04 at March, up 1% year-on-year, in line with IMVe), 8% above the same period in 2019.

- – Hospitality (HOS) continued to clearly outperform 2019 levels, generating 126% pre-pandemic in Q1, or €235m of revenues (€212m IMVe).

- EBITDA in Q1 24 stood at €582 Mn, or 96% of the 2019 level, slightly above IMVe. The company’s operating leverage has been mitigated more than expected by cost increases, with the EBITDA margin in Q1 at almost 39%, very similar to Q1 23 (up 80 bp IMVe). Thus, reported EBITDA was €582 Mn, or 97% of pre-pandemic data, versus €575 Mn IMVe. With no surprises below EBITDA, perhaps due to higher than expected financial expenses, Amadeus reported a net result of €314 Mn, versus €323 Mn IMVe.