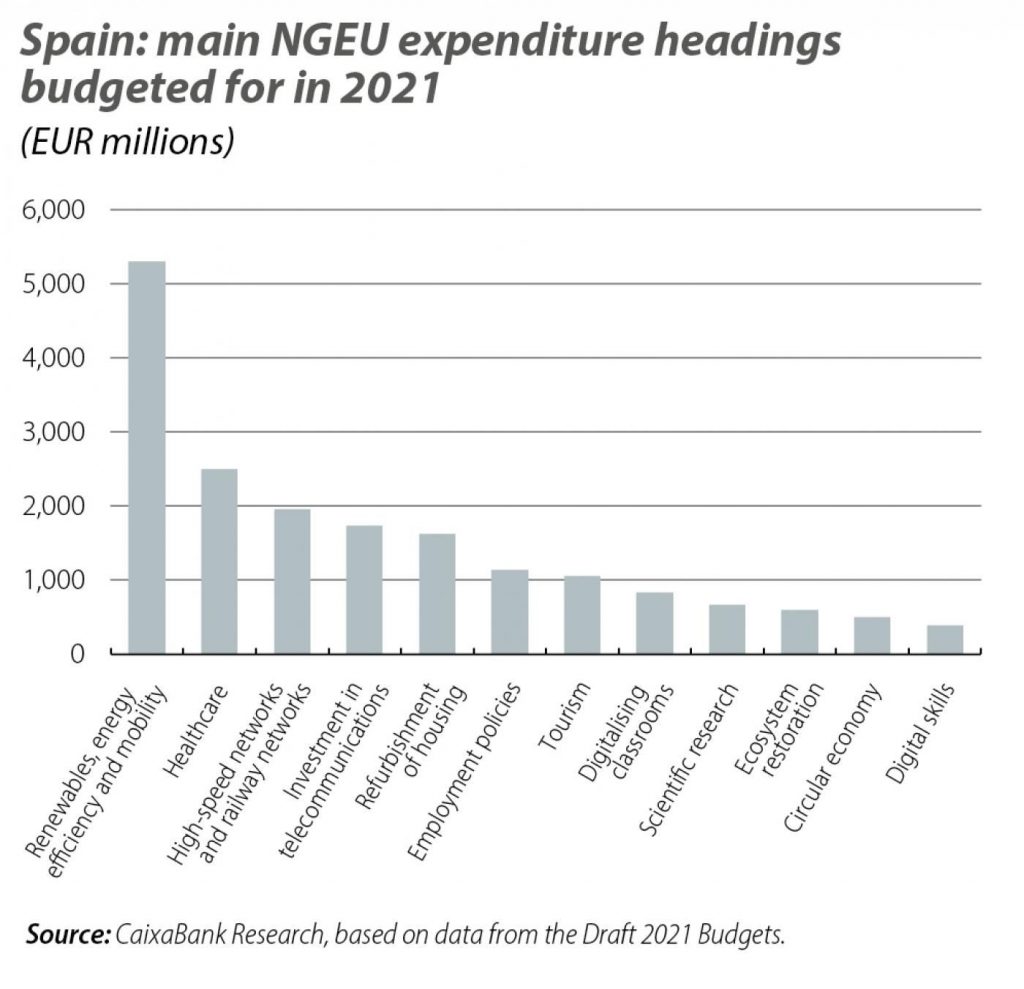

Javier García Arenas (Caixabank Research)| The Recovery, Transformation and Resilience Plan (RTRP) presented by the government to channel European funds from the Next Generation EU (NGEU) Recovery Fund has attracted much interest. The plan provided so far is an initial overview, although the final plan will need to be submitted to the European Commission by 30 April 2021 and should be approved within two to three months thereafter. The overview sets out priorities such as infrastructure, sustainable construction and the refurbishment of housing, telecommunications, energy, and others (see the first chart with the main headings), which are well aligned with the objectives set by the European Commission (mainly green investment and digitalisation), although the projects and their associated milestones are not yet specified. In this article we attempt to make sense of this plan and assess the opportunities it could create for our economy.

The budget is certainly impressive: Spain could receive up to 140 billion euros between 2021 and 2026, between non-reimbursable transfers and loans. In fact, the government intends to request the sum of approximately 72 billion euros in 2021-2023, representing the entirety of the non-refundable transfers, and to leave the loans for later. These are very significant amounts: to put them in context, public investment in Spain in 2019 amounted to 25 billion.

The government expects to implement 26,634 million euros in 2021.

Although the first payment from the European Commission (10% of the transfers, or some 5.9 billion euros) is not expected until mid-2021, the government plans to make a start before even receiving the funds in order to accelerate the investments.

Implementing projects for 26,634 million euros in 2021 is a highly ambitious goal: this is a very considerable amount which, prior to the implementation itself, would require a large number of projects to be selected and designed in record time. Furthermore, interim milestones, targets, costs and benefits will need to be established for each one (as the European Commission has requested be included in the final version of the plan).

Institutional mechanisms: how can Spain get the most out of NGEU?

NGEU represents an extraordinary opportunity to give the Spanish economy a new modernising boost, but effective institutional mechanisms will be essential in order to make the most of it. It will therefore be essential to select the right projects, even more so if the investments are made in advance, before the European Commission gives them the green light, since the disbursement of the funds will be conditional on the milestones laid down being achieved. To this end, it would be advisable to create a specific governance mechanism for assessing, selecting and monitoring the projects in question. At present, it is known that management of the funds will be led by an Inter-Ministerial Commission chaired by the president of the Spanish government. However, the degree of involvement of experts and the private sector is not yet known (a series of high-level forums and councils will be established, although the details and how responsibilities will be shared out are not known). The government also estimates that around 50% of the investments could be implemented by the autonomous communities – with a leading role in areas such as housing, environmental investment and educational policies –, and this will require effective coordination mechanisms between administrations.

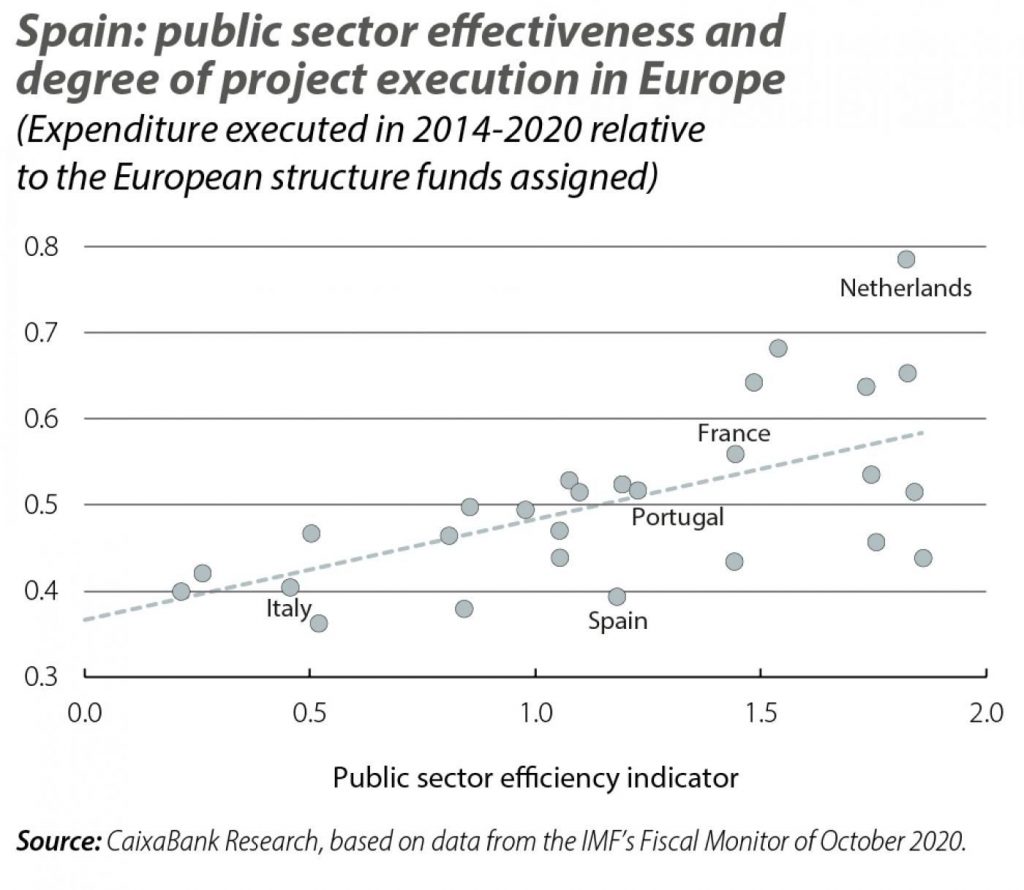

In order to implement the projects effectively, the Plan emphasises the willingness to bolster general government administrations. This is a key element given that, according to the latest IMF Fiscal Monitor, European countries with a more effective public sector are able to implement a larger proportion of the European funds that are allocated to them. Spain, which is classified as having intermediate public sector efficiency (see second chart), has room for improvement.

CUADRO

Spain’s track record in the use of European funds is not good (34% of the structural funds allocated for 2014-2020 have been implemented), but there are two considerations worth taking into account. On the one hand, structural funds tended to be earmarked for very specific purposes, and this made it difficult for sufficient projects to be presented. NGEU, in contrast, gives national governments a degree of choice over what to invest in, provided that the policies align with the objectives set by the Commission – green transition, digital transition, etc. On the other hand, there is a willingness to invest in sectors with a pre-existing productive capacity.

The economic impact of these investments and the definitive green light of the European Council – a qualified majority is needed – as well as that of the European Commission will not only depend on whether the projects’ interim objectives are met, but also on whether they are accompanied by the reforms needed to boost growth potential. The Commission’s guidelines make it clear that each Member State has to link the investments of its Recovery Plan with the specific recommendations of the European Semester. In the case of Spain, two recommendations stand out: facilitating the transition to permanent labour contracts in order to reduce the duality of the country’s labour market, and ensuring the sustainability of the pension system. In this regard, we will have to see how the investments of the Recovery Plan tie in with the pending reforms in these areas.

Final reflections: aggregate impact and an exciting challenge

NGEU could have a very positive impact by boosting confidence in the common European project among economic players and providing more scope to carry out ambitious investment policies. The programme’s macroeconomic impact for 2021 is difficult to gauge at this stage, particularly given the level of uncertainty over the amount of investments that will end up being implemented. Of course, the better the selection, monitoring and assessment of the projects, and the more the public investments go hand in hand with private investment and go to sectors that provide a significant boost to jobs, the greater the final impact will be. The empirical evidence on the magnitude of the fiscal multipliers of public investment places them at around 1 in the short term, an effect that can more than double from the second year.

One area in which the RTRP provides few clues is regarding which specific policies will be implemented to help the sectors hardest hit by the pandemic, such as tourism and hospitality, in order to make them more resilient and prepare them for a rapid recovery. Other countries, such as France, have proposed policies such as providing support for capital injections and direct transfers. It would therefore be feasible to include such policies within the final Recovery Plan.

In short, NGEU represents a golden opportunity to provide a new boost to the Spanish economy. In difficult times like these, it is a promising prospect. But in order to make the most of this opportunity, the expenditure will need to be planned thoroughly and the best tools will need to be made available.