The recent AGM approved a final cash dividend against 2022 of 5.95 euro cents per share, payable from 2 May 2023, meaning the total cash dividend charged against 2022 is up 18% versus the previous year at 11.78 euro cents. The board has approved a new remuneration policy, increasing payout from 40% to 50% of attributable profit in 2023.

While loan-loss provisions were up year-on-year, mainly due to the normalization in provisions in the US as highlighted in previous quarters, provisions fell 3% in constant euros compared to Q4 2022 and cost of risk remained low at 1.05% – below the bank target for the year (less than 1.2%).

In the first quarter as the bank added nine million customers year-on-year, loans and deposits grew by 3% and 6% respectively in the same period in constant euros (i.e., excluding currency movements), supporting solid growth in net interest income (+14% on the same basis), boosted by Europe and North America.

The group’s efficiency ratio improved further to 44.1% as growth in income outpaced growth in operating expenses, despite inflationary pressures and investments in technology and digitalization.

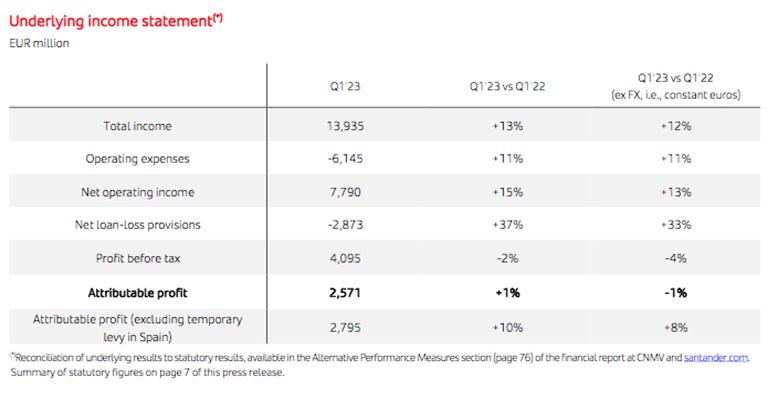

Excluding the impact of the temporary levy in Spain, which was accounted for in full for 2023 during the first quarter, attributable profit was €2,795million, up 10%.

The bank remains on track to meet the 2023 targets outlined in February, including: double-digit income growth; RoTE above 15%; cost-to-income ratio of 44-45%; fully-loaded CET1 above 12%, and cost of risk below 1.2%.

Ana Botín, Banco Santander executive chair, said: “It has been a strong start for the year with income 13% higher than last year driven by growth in customers and volumes, with lending and deposits up 3% and 6%, respectively. Double-digit income growth, improved efficiency and robust credit quality drove our return on tangible equity to 14.4%, up from 13.4% in 2022, while our balance sheet remains rock solid. We are progressing well in our simplification and commercial transformation, and the increasing value of the group is again evident in our results, with 39% of total income coming from our global and network businesses. Despite recent volatility, we are on track to meet our 2023 targets, achieving 5% increase in tangible net asset value per share plus cash dividend per share since the start of the year. Our teams remain focused on supporting customers and continuing to create value for shareholders.”