Spain’s exports are being described as dynamic by analysts, and used as a lifeboat by the country’s government in search of proof that it is managing austerity in the best way possible.

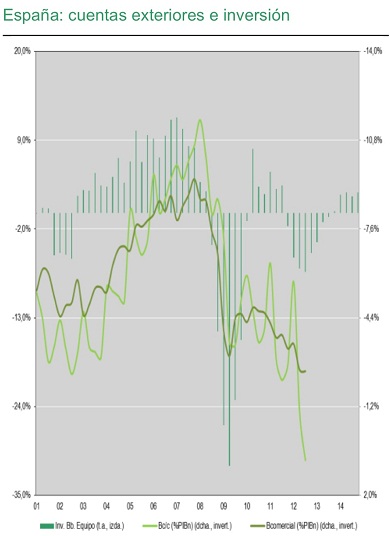

In fact, once we get the complete set of data of last year, the reduction of the external deficit could have almost made even the Spanish current account, which at just -1 percent per nominal GDP would have improved by 2.5 percentage points since 2011.

Yet, BNP Paribas said Friday in a report that figures will soon turn somehow worse: and that’s good news. According to the French bank’s experts, the external deficit has dropped so much not only because Spain has showed to have a stronger exporting muscle than many believed, but because imports have dramatically fallen, too. In other words, the Spanish economy finds itself in a weak condition. “When Spain begins to recover,” BNP Paribas explained, “we expect imports to grow. The trade balance will look then more negative than now, but that will be better, even if it affects the current account balance.” It will mean households and companies are spending at a healthier levels.

Spain’s current account deficit was in 2007 equivalent to 10 percent of nominal GDP, and BNP Paribas believes it will remain nevertheless under 3 percent thanks to the high level of diversification in exports.

For the Spanish government, though, the sooner the trade balance deficit goes up, the more chances it will have to convince voters that their economic pain is worth something.

Be the first to comment on "Say Adiós to the Spanish current account surplus"