Kicking the can down Eurocrisis road? It all depends on how Spain’s government is using renewed inflows of investors’ money. BNP Paribas in Madrid said Wednesday in a report that foreign demand for Spanish sovereign bonds has picked up during the last three months: already in December 2012, non-resident bondholders accounted for 36.5 percent from 30 percent in August–although it was 50 percent in 2011. This year, the Spanish Treasury has been able to obtain more credit that it would need to face debt maturities in January and February.

Yesterday’s auction of Treasury paper was, again, in line with recent similar operations. “The Spanish government surpassed the maximum amount of debt it planned to offer,” BNP explained, “and maintains its good results.” The Treasury placed €5.57 billion, slightly over the €5.5-billion highest figure of the official interval.

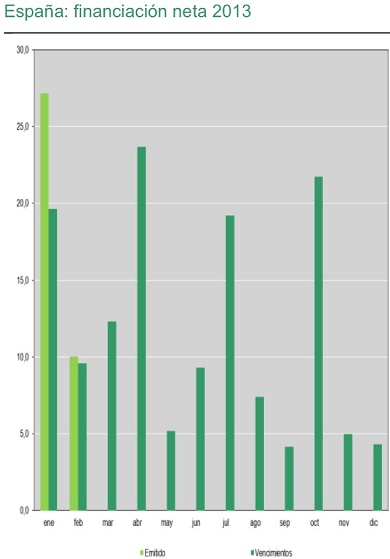

In January, Spain had to repay €19.2 billion in debt maturities and placed €27.2 billion. In February, maturities are €9.56 billion and the government has already sold €10 billion.

The most challenging months in 2013 will be April, July and October. Broker Bankinter remarked the average interest rates on six and 12-month debt paper were lower than in the secondary markets. Bankinter analysts also said successful debt sales of Spain and Italy had “propped up stocks of the European large companies.”

Be the first to comment on "Spanish bond sales higher than debt repayments in 2013"