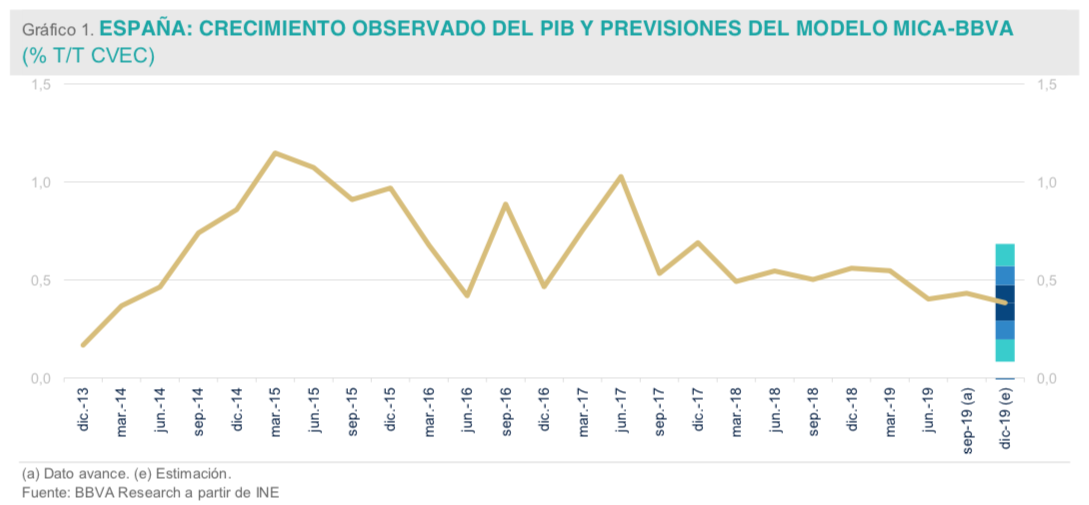

BBVA Research | At the end of the year, the Spanish economy could register three quarters in a row of 0.4% growth t / t, below the growth observed since the beginning of the recovery (0.7% t / t, on average). In this context there is a stabilization of job creation, a volatile composition of demand and low inflation.

With about 50% of the information available for the fourth quarter, the MICA-BBVA1 model indicates that quarterly GDP growth could once again be 0.4% t / t, within the forecast range (between 0, 3% and 0.5% t / t), but below that observed since the start of recovery (0.7% t / t, on average). If this estimate is confirmed, the fiscal year would be closed with an average annual advance between 1.9 and 2.0%, below that observed in 2018.

Consumption supports the increase in domestic demand

Looking ahead to 4Q19, consumer spending and expectations indicators, together with labor market records, support the slowdown in private consumption towards a more moderate growth rate than in 3Q19, although higher than those observed during the first semester of the year Likewise, budget execution data suggest a slowdown in the rate of progress in public consumption to somewhat lower levels than those observed until September.

Regarding the investment, the partial indicators indicate that the one destined to machinery and equipment could go back, after the strong progress observed last quarter, while the residential one would stagnate, after the decrease observed between July and September.

Exports of goods lead the advance of external demand

Available data suggest that, after the slowdown observed in the third quarter, exports of goods could gain traction again at the end of the year. On the other hand, doubts continue regarding the evolution of sales of services abroad, which accumulate two quarters falling. In particular, and although they are expected to return to positive territory in the fourth quarter, the tourism sector continues to show less dynamism than that observed in recent years.

Employment increases moderately, but so does unemployment

BBVA Research estimates indicate that the number of Social Security affiliations would have advanced around 30,000 CVEC people in November, in line with the rate of job creation observed since 2Q19 (32,000 people per month, on average), but below the one registered in 2018 (46,500 people, monthly average). On the other hand, the number of unemployed would have increased marginally (1,200 CVEC people), which implies the fourth monthly advance of unemployment in 2019, after those registered in June, July and October. If these trends continue in December, 4Q19 could close with employment growth close to 0.5% t / t CVEC, but also with a marginal increase in registered unemployment that would break the downward trend registered since 2Q13.

Inflation remains low

General inflation increased to 0.4% a / y in November, due to the lower downward pressure on the residual component (energy and unprocessed food) and the stability of core inflation. Thus, the growth in general prices in November turned out to be 0.5pp lower than that registered in all EMU countries. In the case of the underlying component (which excludes energy and unprocessed foods), BBVA Research estimates indicate that the differential was similar (-0.4pp).

This trend seems to continue in December, which could lead to an increase in general inflation to around 1.0%, in line with the forecast of core inflation.