MADRID | The financial City of Madrid was coming Monday to the conclusion that a rapid intervention from the European Central Bank would be the only effective barrier to support Spanish sovereign bonds in the markets. The alternative of using the assistance programmes of rescue funds European Financial Stability Facility and European Stability Mechanism to buy debt in the primary and secondary markets had pushed aside the ECB recourse. This week might be the right time to bring it back.

Events are developing at a higher speed than th

ought before. Afi analysts noted this morning that

“the European bailout funds, either the EFSF or the ESM, lack the ability to act immediately. It's the ECB the one that could act as a safety wall in the bond market.”

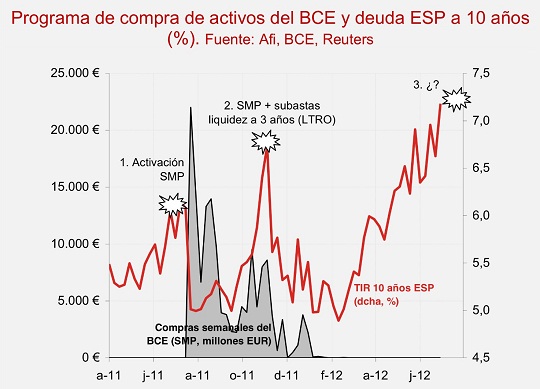

Here's a chart with a red line for Spain's 10-year bond yields and its correlation to the ECB's securities market programme.