Sean MarKowicz (Schroders) | The economic fallout of Covid-19 has wreaked havoc for income-seeking investors. Across the globe, interest rates have tumbled to record lows and equity dividends have been drastically cut.

For example, this year dividends per share are expected to fall by 16% to 36% across the globe compared with 2019, with the UK and emerging markets (EM) among the worst affected regions. This has left investors nursing losses from normally dependable sources of income.

However, that narrow assessment of the situation means that many people have missed an equally big development – many equity markets are now expected to generate a commensurate or higher yield than corporate bonds.

Here are three charts that show how income opportunities compare for equities and bonds across different geographies.

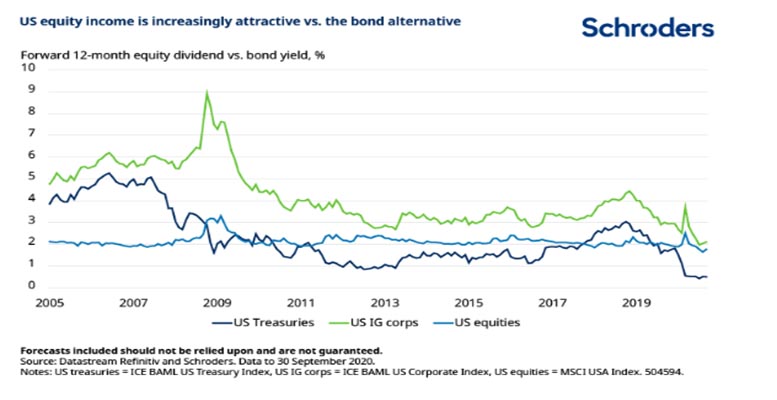

1. Ultra low bond yields have rendered US dividends more attractive than ever

In the past, US equities would not have appeared compelling from an income perspective. They have a reputation for having a low dividend yield versus other markets, as share buybacks are the preferred way of returning cash to shareholders.

However, given today’s ultra low yield environment, this view no longer seems tenable. For example, since 2005 investment grade (IG) US corporate bonds have on average yielded 2% more than US equities. Today that yield differential is just 0.3% (see chart above). Investment grade bonds are the highest quality bonds as determined by a credit rating agency.

This comparison is made using forward dividends because bond yields are a measure of the income that will be earned over the coming year, which is more comparable to the forward dividend yield. This is a forecast that may or may not be realised. However, even on a trailing basis, the US dividend yield is comparable to the US corporate bond yield and vastly exceeds it in other markets, as we will see below.

Equities are of course a riskier investment option as investors may not get back the original capital they invested. But in exchange they offer the potential for capital appreciation, as well as dividend increases.

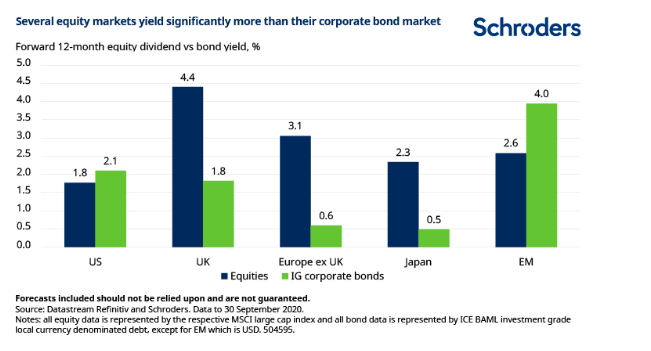

2. Stocks vastly trump corporate bonds in Europe and Japan

The appeal of equity income looks even mightier outside the US. For example, over the next 12 months, European (ex UK) equities are expected to generate a yield that is five times greater than that of Euro IG corporate bonds.

Similarly, UK equities are expected to yield 4.4% – the highest dividend of any major equity market globally and twice as much compared to sterling IG corporate bonds.

Although EM corporate bonds still retain an income advantage versus their equity peers, investors would be wise to diversify their portfolio risks across different geographies and asset classes, even if it means forfeiting some income.

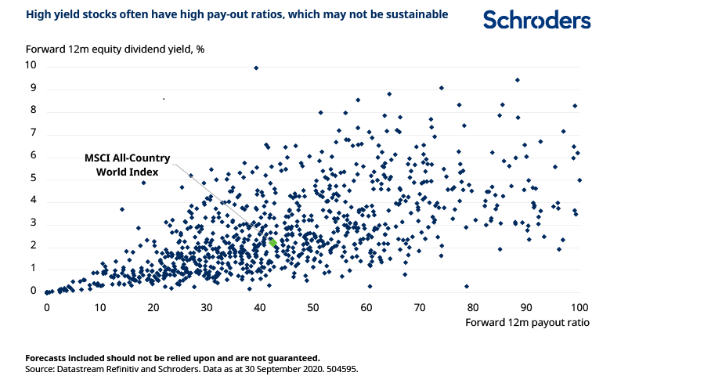

3. High yield stocks are often companies with high pay-out ratios

As well as the value that diversification may bring to a portfolio, the same is true of security selection. With 800 out of the 1600 stocks in the global stock universe (MSCI All Country World Index) paying a yield in excess of the market average, there are clearly a number of global opportunities available to income investors.

However, investors should not simply pursue the high octane option without due diligence. The dividend yield of a company is equal to its dividend per share divided by its price per share, so a high dividend yield could either be because a company is paying a high dividend or because its price has fallen. For investors seeking sustainable dividend income, both possibilities need further investigation.

Namely, it is important for investors to distinguish between companies that are temporarily undervalued by the market (share price has fallen too far) and those facing structural difficulties.

Besides this, it is worth mentioning that the highest dividend stocks are often those with high pay-out ratios – they distribute a high proportion of their profits in the form of dividends. Many are also paying out a higher proportion of their profits than they have done in the past to hold their dividends up. Neither may be sustainable. A high yield today could easily turn into a low yield tomorrow.

Not all high yielding stocks fall into this area of concern, however. There are many companies which pay a yield in excess of the market at a similar or lower pay-out ratio, representing a potentially more appealing option. This is shown in the chart below.

Although EM corporate bonds still retain an income advantage versus their equity peers, investors would be wise to diversify their portfolio risks across different geographies and asset classes, even if it means forfeiting some income.