Today it’s Argentina making headlines but other economies should be concerned: vulture funds which refused to participate in two debt restructuring processes are now celebrating a New York Judge’s ruling that sets a damaging precedent: why would anybody accept writedowns if he can be paid in full?

Buenos Aires’ position may have flaws, but it is consistent: agreeing to the hedge funds’ demands would break the country’s law, which bans it from offering better terms than those who accepted steep writedowns in the 2005 and 2010 swaps.

The solution might be collective action clauses (CAC), which allow a supermajority of bondholders to agree to a debt restructuring that is legally binding on all holders. But today many bond issuances susceptible of restructuring processes are regulated by non-national laws and any bondholder can play the wet blanket.

This ruling adds a problem to the already battered economy of Argentina, in recession since 4T13, joined to the vertical depreciation of the peso against the USD in 2014 (25%) and the presence of high inflation that constrains growth.

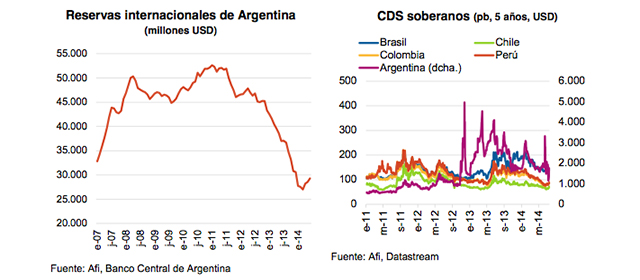

“In addition, the lack of access to the global capital markets requires Argentina to maintain its balance abroad. A difficult goal to achieve given the loss of competitiveness and the widening energy deficit, all of which put the country’s international reserves under pressure (today at 29 billion USD, compared to 37 billion mid-2013),” analysts at Afi explained.

Be the first to comment on "Argentina: Griesa’s ruling sets dangerous precedent in debt restructuring processes"