March Bank| The US president’s budget plans seek to increase spending as well as tax revenue through increases in corporate income tax, a higher minimum rate for businesses, and at the personal level, a new minimum rate for billionaires. In higher tax revenues, an estimated $4.9 trillion is expected to be raised over the decade, including $1.4 trillion from the increase in the corporate tax rate to 28% and $502 billion from the “billionaire tax”, which would impose a minimum tax of 25% on individuals with a net worth of more than $100 million. Although the deficit would be contained in the long term (3.9% in 2034), it would not be enough to limit high debt levels: from 99.6% in 2024 it would rise to 102.2% in 2025 and 105.6% in 2034. Congress is unlikely to pass these proposals, as the House of Representatives is controlled by Republicans. For his part, Trump, should he be elected, has pledged to update the significant tax cuts implemented during his term in office and to reduce government spending.

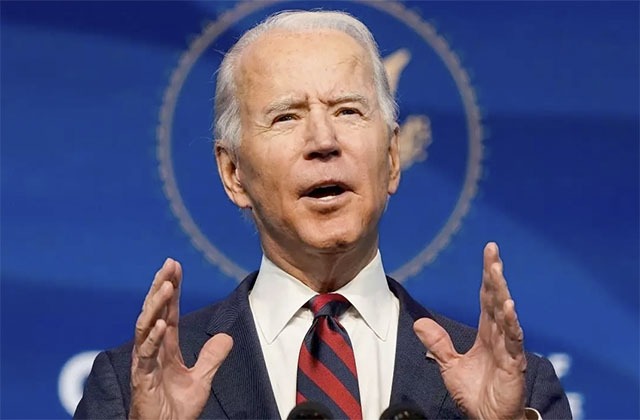

Biden approves budgets that would reduce deficit by $3bn over next 10 years, but would not limit high debt levels