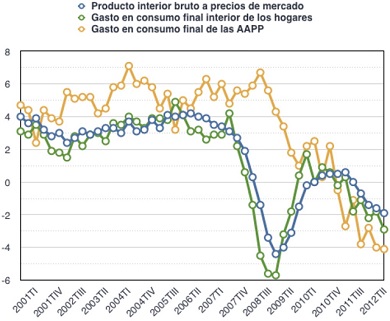

Say what you want about our unavoidable austerity and necessarily tough deficit targets. But it’s hard to deny that in Spain, right now, the public administrations’ spending behaves in a very independent way from private consumption and GDP changes. In fact, the correlation seems to go in the opposite direction. When GDP and private consumption fall, public spending automatically comes in trying to fill the gap.

One obvious conclusion would be that private consumption has much stronger influence over the other two indexes than many will admit. When private consumption drops, GDP and public spending fall, too, and this fact just reveals to what extent the government’s assumptions are wrong: cuts in public spending do not always free resources that will impel the private sector to expand. In these currently depressive environment, that is not what happens. It might be true in an upwards market, but definitely not now.

Reigning in the public sector under austerity plans isn’t good for the private sector, at least not today and not when a country has lost his monetary policy sovereignty. Indeed, what we have seen is that the multiplier effect of the public spending rate in a recessive economy is very powerful.

The theory that adjusting fast the deficit of the public administrations is a condition to return to growth was based in some studies, Reinhart-Rogoff‘s being one of them although the most influential in the EU. If debt per GDP gets above 90 percent, they said, GDP rates will not improve. Brussels took it to heart and has imposed it on peripheral economies. But the Reinhart-Rogoff paper was inaccurate, to say the least.

Some students, using the same data as in the Reinhart-Rogoff’s calculations, showed that there are European countries with such debt per GDP ratio and growth over 2 percent. Indeed, the evidence points at a different verdict: it’s GDP falling that increases debt per GDP rates. The debt per GDP figure cannot fall if the main interest rates is higher than the eurozone’s GDP; simples.

Thank you for your comments, I really liked your article.