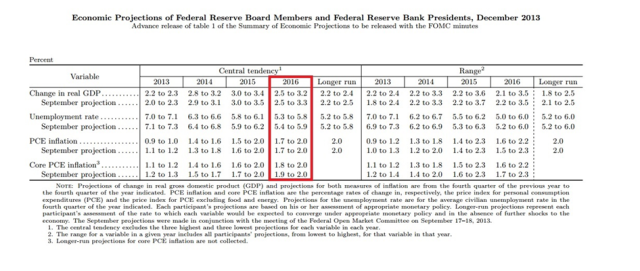

According to the “outlook”, interest rates are likely to remain down into 2016 because inflation will likely still be below the Fed´s target.

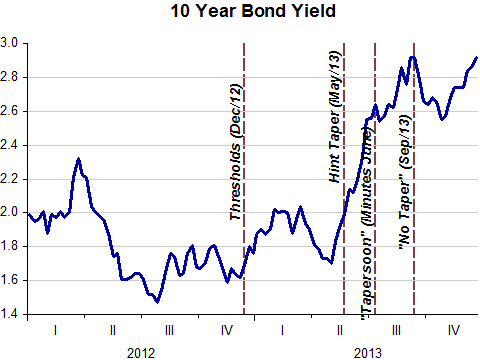

The Fed would always say, about its securities purchases:

Taken together, these actions should maintain downward pressure on longer-term interest rates, support mortgage markets, and help to make broader financial conditions more accommodative.

As the chart shows (weekly data) that never happened:

And that´s (according to Scott Sumner) “A classic example of how interest rates tell us very little about the stance of monetary policy.”

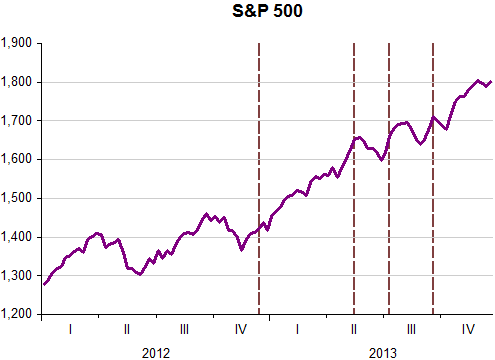

The stock market has mostly been on an uptrend:

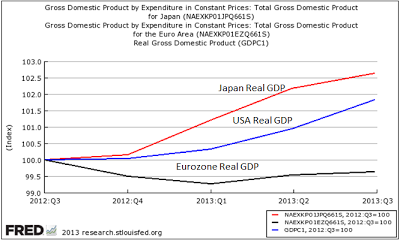

And as David Beckworth illustrates, the QE + Forward Guidance group has performed significantly better than the Euro group (and better the more QE+FG):

Just imagine if the Fed had been clear on its communications, something it could have accomplished by stating a level target for NGDP!

Be the first to comment on "Federal Reserve: “Extended Insurance”"