Mathieu Racheter, Strategy Research, Julius Baer | Global healthcare remains our most preferred defensive sector due to attractive valuations in combination with solid growth perspectives. We see a number of structural tailwinds including demographics, big data, and increased demand in emerging markets, all of which should continue to drive above-average sales and earnings growth going forward.

Healthcare remains our most preferred defensive sector due to attractive growth perspectives and undemanding valuations. We expect the healthcare sector to generate better organic earnings growth than almost all other defensive sectors, both this year and next. This above-average growth potential continues to be driven by favourable demographic changes, new drug developments, and general innovations in the area of cures and disease preventions.

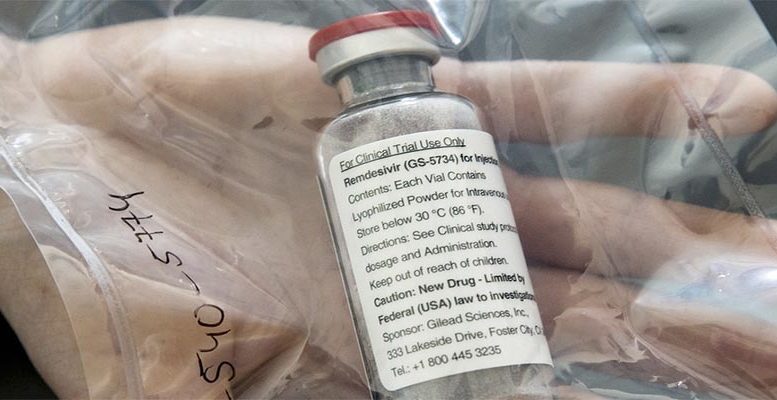

Growth related to demographic changes primarily results from the sharp rise in the number of people over the age of 65 (+3.4% per annum according to the United Nations), who tend to spend three times more on healthcare than the rest of the population. Moreover, the pipeline for new drugs looks attractive and should be able to more than offset the wave of major patent expiries starting in the mid-2020s, in our view. With regard to US politics, fears about price control and major changes to the US healthcare system tend to be systematically overestimated, in our view.

Healthcare reforms in the US are highly complex and take time to be implemented. Moreover, prescription drugs represent less than 10% of total US healthcare spending and therefore price cuts can only deliver a small proportion of the total cost cuts needed. Overall, we expect further disinflation in the US healthcare segment, but this is already reflected in valuations.

Relative to the broad market, healthcare stocks trade at a double-digit discount and close to historical trough levels. In our view, healthcare should trade at a double-digit premium to the broad market, due to above-average quality, stronger balance sheets, and higher visibility in combination with better growth perspectives. Against this backdrop, we continue to recommend overweighting the sector in a global equities portfolio.